Prescription drug costs are climbing, and fast. For HR leaders and benefits decision-makers, these rising expenses are more than just numbers on a spreadsheet. They directly affect employee satisfaction, retention, and overall health outcomes. Understanding what’s driving these costs and how to manage them is key to protecting your workforce and your budget. Let’s break down the trends, the impact on your people, and what smarter pharmacy benefits can look like in 2025.

Why Prescription Drug Costs Are Exploding

If it feels like pharmacy costs are spiraling out of control, that’s because they are. The cost of prescription drugs is outpacing overall medical inflation, with a projected growth rate of 7.4% in 2024, according to Aon’s 2024 Global Medical Trend Rates report. [1] For HR and benefits leaders, that’s not just a statistic, rather it’s a growing line item on budgets and a pain point for employees.

A major contributor? Specialty drugs. These high-cost medications — often used to treat complex conditions like cancer, rheumatoid arthritis, and multiple sclerosis — now account for over 50% of total pharmacy spend, despite serving less than 2% of patients. [2]

The rising interest in GLP-1

But the fastest-growing driver of pharmacy spending is coming from a new category: GLP-1 medications like Ozempic and Mounjaro. Initially prescribed for diabetes, these drugs have surged in popularity as weight-loss solutions. In fact, according to our proprietary research in The 2025 Benefits Divide report, 16% of all weight-related benefits searches now focus on GLP-1 medications, reflecting skyrocketing interest and rising demand across employer-sponsored plans.

For HR leaders, these numbers are more than just eye-catching … they’re a call to action. Prescription drug costs aren’t slowing down, and without a strategy, they’ll continue to put pressure on both company budgets and employee wallets.

The Impact on Your Employees (And Why HR Needs to Act)

Rising pharmacy costs don’t just strain company budgets — they directly affect your employees’ financial health and well-being. According to the Kaiser Family Foundation 2023 Employer Health Benefits Survey, more employees are being forced to delay or skip medications due to high out-of-pocket costs (Kaiser Family Foundation, 2023). [3] These decisions can have serious health consequences, leading to unmanaged conditions and higher costs down the line.

Chronic conditions amplify the problem. In 2024, nearly 1 in 4 diabetes-related benefits searches focused on supplies and equipment rather than prescriptions alone, indicating a growing need for comprehensive support. [4] Employees aren’t just looking for medications, rather, they need help managing their entire care journey.

And the impact on talent retention is significant: 49% of employees say they would leave a job over inadequate benefits, according to the Forbes Advisor 2023 Health Benefits Study. [5] For HR leaders, that means every gap in coverage or benefit support is a potential risk to employee satisfaction, productivity, and loyalty.

Managing rising prescription costs starts with more than plan design, it requires a focus on holistic employee health and well-being. When employees feel supported with benefits that address mental health, work-life balance, and preventive care, they are more likely to stay healthy and avoid costly medical issues. HR leaders can take proactive steps by reducing burnout and encouraging healthier work habits. Learn more about the connection between well-being and long-term healthcare costs in this blog on the hidden dangers of working long hours.

If you’re not addressing rising pharmacy costs with proactive, whole-person strategies, you’re not just risking overspending — you’re risking losing your people.

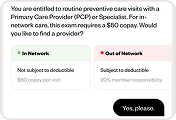

Smarter Pharmacy Benefits Start With Transparency and Choice

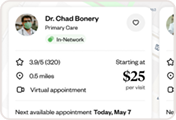

HR leaders can’t control the price of medications, but they can control how employees access them. The most effective pharmacy benefits strategies start with one word: transparency. Employees need real-time data on drug pricing, formulary options, and alternative therapies — all in one place. Without it, they’re left guessing (and overspending).

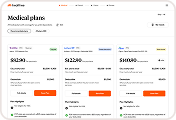

Proactive plan design also matters. Consider adding discount pharmacy cards or employer-backed solutions that allow employees to shop for the best price across different pharmacies. These programs can reduce out-of-pocket costs significantly, offering employees the flexibility they crave. According to the Mercer 2023 Survey on Health and Benefits, employers who offer creative solutions for specialty drugs and high-cost medications report better employee satisfaction and cost containment.

The future of pharmacy benefits is integrated and employee-centric. Smart HR leaders are investing in tools that help employees:

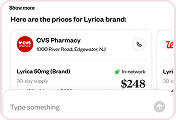

- Compare prescription costs in real time

- Navigate complex formularies without confusion

- Make smarter, cost-effective healthcare decisions year-round

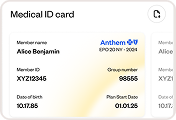

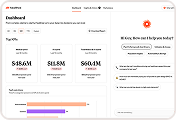

Healthee’s platform, for example, allows employees to search for medications, view pricing data, and access AI-powered support from Zoe, their personal health assistant, helping them make confident choices without HR intervention.

By putting transparency and choice in the hands of employees, HR teams can control pharmacy costs while building trust and loyalty.

In the End

Rising prescription drug costs aren’t just a budget challenge — they’re a workforce challenge. With pharmacy spend growing 7.4% in 2024 and specialty drugs accounting for more than half of that spend, employers need to act with urgency. GLP-1 medications like Ozempic and Mounjaro are only accelerating this trend, capturing growing employee demand.

The real cost? Employees delaying care, skipping medications, and feeling unsupported. For those managing chronic conditions, the stakes are even higher. When employees can’t afford to manage their health, productivity dips, satisfaction erodes, and turnover rises — with 49% of employees willing to leave a job over inadequate benefits.

The solution starts with transparency and choice. HR leaders who equip their people with real-time cost data, easy-to-navigate formularies, and smart pharmacy tools empower employees to become better healthcare consumers. And platforms like Healthee make it simple — giving employees the power to make informed decisions while reducing HR’s administrative burden.

At the end of the day, controlling pharmacy costs isn’t just about savings — it’s about investing in the health, happiness, and loyalty of your workforce. Forward-thinking benefits leaders who tackle this head-on will strengthen both their culture and their bottom line.

References:

1. Aon. (2023). 2024 Global Medical Trend Rates Report.

2. Mercer. (2023). Survey on Health and Benefits.

3. Healthee Internal Data. (2024).

4. Kaiser Family Foundation. (2023). 2023 Employer Health Benefits Survey. Retrieved from

5. Forbes Advisor. (2023). 2023 Health Benefits Study.

Disclaimer: This blog is intended for informational purposes only and does not constitute legal, financial, or medical advice. Employers and HR professionals should consult with qualified advisors and healthcare professionals before making decisions about benefits design or healthcare policies.