Before designing your employee benefits strategies, it’s essential that you clearly define your company’s benefits goals. Are you focused on reducing healthcare spend? Increasing employee engagement?

With rising healthcare costs and a shift toward personalized AI-driven support, your strategy must be more agile than ever. In this post, we’ll walk through how to build an effective employee benefits strategy that supports your goals in today’s ever-changing landscape.

Here are a few goals that an effective employee benefits strategy can support:

What are employee benefits strategies?

Employee benefits strategies are the structured plans employers use to design, deliver, and manage benefits in a way that supports business goals and employee needs.

At a basic level, a benefits strategy answers this question: How do we invest in our people in a way that attracts talent, controls costs, and drives engagement?

Top employee benefits trends and benchmarks

Here are key employee benefits trends we expect to see develop over the next year:

- Personalization and choice: Employees increasingly expect tailored benefit options that fit their life stage and needs (e.g., flexible benefit allowances).

- Health and well-being focus: Mental health support, holistic wellness programs, and preventative care continue to surge.

- Remote and flexible work support: Benefits that support hybrid/remote work and work-life balance are now core expectations, not extras.

- Data-driven strategy: Employers are using analytics and benchmarking to compare offerings against industry norms and employee usage patterns. By aligning your strategy with these trends, you can better meet employee expectations and stand out in competitive talent markets.

The 6-step roadmap to developing your benefits strategy

1. Audit current performance

Analyze last year’s utilization data. What did employees actually use?

2. Align with business objectives

Is the goal to reduce turnover (retention) or lower overhead (cost containment)?

3. Determine your budget and return on investment (ROI)

Benefits usually cost 30-40% of total compensation. Define your “must-haves” vs. “nice-to-haves.”

4. Survey for demographics

Use pulse surveys to inform your next steps. For example, you can ask younger generations if they want access to mental health apps or if older generations want better HSA options.

5. Select your tech stack

Implement a navigation platform (like Healthee) to ensure your employees use their benefits.

6. Measure and iterate

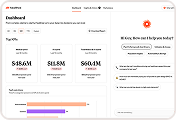

Use real-time dashboards to adjust your strategy mid-year.

How to measure your benefits strategy

Measuring your strategy’s progress and benchmarking against others in your industry can help improve your ROI.

Here are useful metrics to track:

- Participation rates: Which benefits employees are actually using.

- Employee satisfaction surveys: Sentiment about the benefits package.

- Recruitment and turnover data: Use this to correlate benefits with retention performance.

- Cost per benefit vs. outcomes: Evaluate financial efficiency.

Key employee benefits to consider

Mental health

Mental health support has officially shifted from a “culture perk” to a primary business infrastructure. According to the 2025 Milliman Medical Index,¹ healthcare costs for the average person have surged, with behavioral health utilization climbing 45% between 2023 and 2025.

This demand is driven by a workforce at its breaking point. The 2025 NAMI/Ipsos Workplace Poll reveals that 92% of employees consider mental health coverage a non-negotiable baseline for a healthy corporate culture.² Furthermore, the 2026 Mercer Health Trends Report highlights that nearly half of all U.S. employees now feel stressed “most days” at work, leading 75% of large employers to prioritize digital resiliency and AI-driven navigation tools in their 2026 strategies.³

Telehealth

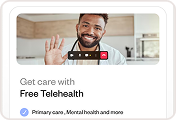

Now that virtual meeting software has become more common in the medical field, telehealth services are top of mind for employees. As part of Healthee’s platform, we offer 24/7 telehealth care — free of charge.

Employees can connect with licensed professionals for immediate guidance on health concerns, from mental health support to general medical advice. The telehealth feature integrates directly into the Healthee app, making it simple for users to schedule appointments, receive healthcare support, and access personalized recommendations based on their unique health and coverage needs.

Financial wellness

Employees are focused on financial wellness now more than ever as the cost-of-living gap widens. According to the 2025 PwC Employee Financial Wellness Survey and updated Mercer Health and Benefit benchmarks⁴:

- 63% of employees say their financial stress has increased since 2024, citing persistent inflation as the primary driver.

- 48% of workers have officially paused or reduced retirement contributions to cover immediate monthly expenses.

- Financial anxiety is the new absenteeism: Employees stressed about money are 4.1x more likely to be looking for a new job, making financial benefits a critical retention tool for 2026.

Modern strategies are shifting from simple “education” to Financial Action Tools, such as AI-driven debt management, emergency savings accounts (ESAs), and real-time student loan matching.

Pet insurance

Offering pet insurance to employees who absolutely adore their furry (or slithery) friends is not standard. However, if you want to delight employees, particularly millennial employees, this can be a huge way to attract top talent.

GLP-1 and weight management support

With the surge in demand for weight-loss medications, 2025 strategies must address clinical oversight and cost-sharing for these high-cost specialty drugs.

Financial resilience and secure 2.0

Following the SECURE 2.0 Act, more companies are offering emergency savings accounts (ESAs) linked to retirement plans to help employees manage short-term crises.

Women’s health and menopause support

Moving beyond basic maternity, top strategies now include specialized support for menopause, fertility, and PCOS care.

Health insurance navigation

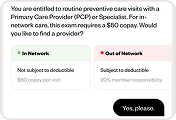

Everyone knows that the US healthcare system is painfully difficult to navigate. Healthcare navigation solutions have the potential to make employees’ lives better and encourage them to use their benefits more efficiently.

In 2026, the biggest hurdle isn’t a lack of benefits — it’s point solution fatigue. Employees are overwhelmed by having 10 different apps for 10 different benefits. A winning 2026 strategy uses a centralized AI-powered hub (like Healthee) to consolidate these tools, providing a single ‘front door’ for all healthcare and wellness needs.

Here are a few things our navigation platform is doing for employees nationwide:

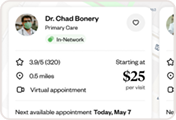

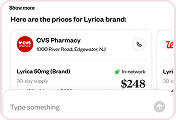

- AI-powered personalized answers to healthcare navigation queries

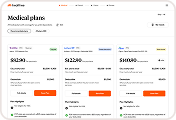

- Seamless open enrollment support so employees can easily compare various health plans for their own specific needs

- Real-time insights for the HR team to analyze current data on healthcare costs and trends

- Data-driven preventive care recommendations to encourage healthy lifestyles and improve employee satisfaction

- Mobile app convenience to allow employees to access vital health plan info even when not at their computers

General employee benefits categories

Most employee benefits fall under these five main categories:

1. Health and wellness benefits

Health and wellness benefits can be in the form of:

- Health insurance (medical, dental, vision, mental, etc.)

- Life insurance

- Disability insurance

- Wellness programs (gym memberships, sports fest, etc.)

- Employee assistance programs (counseling and support services)

2. Retirement and financial security benefits

Retirement and financial security benefits help employees prepare for their future and protect their financial stability.

This category typically includes:

- Retirement plans (401(k), pension schemes, superannuation)

- Stock options and company equity

- Financial planning services (teaching employees to save, invest, and spend their money effectively)

3. Work-life balance benefits

SurveyMonkey data shows that 28% of all employees rank work-life balance as the top motivator at work. This preference is even more prevalent among Gen Z workers, 32% of whom say work-life balance is the most important aspect of a job.⁵

Work-life balance benefits are designed to help employees manage their personal and professional lives more effectively and include:

- Paid time off (vacation, sick days, personal days)

- Flexible working arrangements (remote work, flexible hours, etc.)

- Parental leave (maternity or paternity leave)

- Childcare assistance

- Petcare insurance

4. Performance and recognition benefits

Rewarding employees for their hard work and achievements can motivate them to maintain high performance levels and increase your company’s talent retention. And this is the main goal of performance and recognition benefits.

This benefits category can be in the form of:

- Bonuses

- Performance incentives (commission-based or fixed financial incentives based on a KPI)

- Recognition programs (employee of the month, service awards, etc.)

5. Professional development benefits

Professional development is one of the most important factors in retaining your best talent. These benefits are vital not only because they enhance employees’ skills but also boost job satisfaction by showing employees that their company invests in their future success.

This type of employee benefit commonly includes:

- Tuition reimbursement (typically for further education in courses relevant to the employee’s role)

- Training and development programs

- Conferences and workshops

- Career coaching

Employee benefits strategies

Employee benefits strategies usually center on the following goals: cost containment, talent attraction, employee satisfaction, employee wellness, legal compliance, DEI, scalability, and using technology to boost efficiency.

Here are some specific strategies you can explore:

Total rewards strategy

This comprehensive approach includes compensation, benefits, well-being initiatives, recognition, and career development opportunities, aiming to address all aspects of an employee’s professional and personal needs based on Maslow’s hierarchy of needs (see below for more on the Total Rewards Strategy).

Employee value proposition (EVP)

Tailored to enhance employer branding, the Employee Value Proposition strategy defines and communicates the unique set of benefits and opportunities provided to employees, encouraging engagement with organizational values and goals.

Well-being approach

Slightly different from the Total Rewards Strategy above, the Wellbeing-Centric Approach focuses specifically on employee health and wellbeing. This strategy incorporates physical, mental, and financial wellness programs, aiming to boost productivity and satisfaction by providing extra support to employees physically and emotionally.

Flexible benefits strategy

The Flexible Benefits Strategy gives employees the flexibility to customize their benefits packages to suit their specific needs and life stages, offering choices in health coverage, retirement planning, and work-life balance options, among others.

Performance-linked rewards strategy

By connecting benefits directly to employee performance through bonuses, stock options, and other incentives, its main objective is to drive engagement and align individual achievements with company objectives.

Career development strategy

The career development strategy gives employees the opportunity for continuous learning and growth, preparing them for future roles and enhancing retention by investing in their long-term career paths. See the section above about “Professional development benefits” for more about how career development and skill development are extremely important for employee retention.

These strategies not only support a dynamic and evolving workforce but also help sculpt a workplace culture that values both individual and collective contributions.

Why most benefits strategies fail (and how to fix them)

Even the most expensive benefits package will fail to provide ROI without an intentional, proactive communications strategy. What can employers do to ensure employees fully understand how to use their benefits?

We believe the answer is data-driven personalization. A modern employee benefits strategy must move away from the “one-size-fits-all” model. By leveraging AI-powered benefits navigation, HR leaders can:

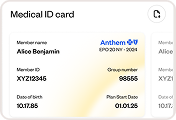

- Reduce admin burden: Let AI handle common questions like, “How do I find my insurance cards?”

- Lower healthcare spend: Direct employees to high-value, low-cost providers.

- Increase engagement: Send personalized preventive care recommendations based on real-time data.

How to choose the best employee benefits strategy

1. Assess your company’s objectives and budget

Start by evaluating your company’s goals. Do you want to increase employee retention? Minimize employees’ healthcare costs? Attract high-quality employees?

You have to be very clear with your objectives because this will tell you which benefits you should offer and how you are going to offer them to your employees. Then, review your company’s financial capabilities against new benchmarks.

As of 2025, the average annual premium for family health coverage has reached nearly $27,000, a 6% increase from the previous year. Employers are now focusing on strategies like HDHP/SO (High Deductible Health Plans with a Savings Option), which offer premiums nearly $1,500 lower on average for family coverage.

However, some benefits, such as technology-based benefits, are “double-edged” to save money and provide a better employee experience.

2. Analyze your workforce demographics, benefits needs, and preferences

Consider your employees’ overall demographics, including:

- Age

- Gender

- Marital status

- Number of children

- Geographical locations

If you don’t have anonymous employee health data to consider, send surveys or conduct voluntary health risk assessments to gain insights into common health issues or needs among your employees.

And don’t forget to look at how your current benefits are actually being used. Are there some that have higher or lower utilization rates than was expected? If so, is there a problem causing that that can be fixed, or is this just an indication that it’s more worth investing in different benefits?

Finally, look for patterns. Identifying patterns in benefits usage can help you predict future needs and guide adjustments. For example, if more employees start using mental health services, it may indicate rising stress levels within your company. This could be addressed through adding support programs, etc.

If you use a health benefits navigation platform such as Healthee, which records and displays the data analysis for you, that can streamline this entire step.

3. Benchmark against industry standards

Now that you have insights into the most used benefits and your employees’ demographics, research what competitors are offering in terms of these benefits.

Get a sense of:

- The types of benefits offered

- Benefits levels (extent of health coverage, employer contributions to retirement plans, or the specifics of parental leave policies)

- Cost-sharing (how costs are shared between the employer and employees)

Then, align this data with the preferences and needs identified in your workforce analysis.

4. Design the benefits package

Based on your research, tailor your benefits offerings to your employees’ life stages, needs, and preferences. For example, if you’re looking to attract freshly graduated employees, you may want to consider offering student loan repayment assistance.

It’s ideal to align the needs and preferences of your workforce with the benefits you offer while ensuring flexibility in your options. After looking at the data you have, you will see that — although there’s no way to give all of your employees the perfect benefits package for each one individually — it is possible to offer a range of customizable options that allow each employee to tailor their benefits to best fit their individual circumstances and life stages.

Of course, partnering with reputable providers and benefits brokers while asking them the right questions can help ensure quality service and competitive pricing.

5. Communicate the benefits to employees

It doesn’t matter how well you’ve aligned the needs of your workforce with your benefits. If your employees don’t understand your benefits packages, they probably won’t engage with them. Finding creative, consistent ways to talk to employees about benefits will make a real difference.

6. Monitor and evaluate the benefits program

Regularly review how many employees are signing up and using each benefit. Low participation might indicate that a benefit is not valued or well-understood.

Occasionally, you also want to consider asking your employees for feedback about the benefits they have. But employee satisfaction isn’t the only thing you have to consider…

On top of that, analyze the financial cost of each benefit versus the budget you set. This will tell you if the benefits are sustainable under the company’s financial conditions.

Pro tip: Be prepared to pivot. As the workforce demographics and lifestyles change, so too should the benefits program.

Strengthen your 2026-2027 employee benefits strategy

Designing a competitive, data-driven employee benefits strategy is all about creating a system that balances cost control, employee experience, and long-term growth. Top employers will use high-quality insights to guide decisions, simplify navigation, and help employees actually use the benefits they’re offered.

If you’re ready to turn your benefits strategy into a smarter investment, book some time with our team! We’re happy to share how Healthee’s AI-powered platform can help you reduce costs, increase engagement, and make benefits work better for your entire organization.