As employee expectations change, HR teams are reimagining what wellness benefits should look like today. But, even with the best intentions, many wellness programs often fall short because employees don’t engage with their benefits.

One survey found that 68% of workers don’t use the full value of their company’s well-being resources because the programs are too “time-consuming, confusing, or cumbersome” to access.¹

In this blog, we’ll explore modern wellness benefits, how to design a program that actually drives results, and what trends are shaping the future of employee well-being.

Whether you’re launching a program or adjusting your current one, this overview will help you build a wellness strategy that supports your people and your bottom line.

The rise of wellness benefits

Wellness benefits have evolved from the occasional step challenge or office yoga session to a core pillar of the employee experience. Why? Because health and wellness, retention, and productivity are now inextricably linked.

Research from Gallup revealed that $322 billion of turnover and lost productivity costs globally are due to employee burnout.² Well-being influences more than just how employees feel — it affects job performance, burnout levels, and their likelihood of staying with your organization.

In a post-pandemic world, employees expect support beyond basic medical coverage. They want tools to manage stress, build healthy habits, improve financial wellness, and feel cared for as a whole person — not just a worker.

Wellness benefits have the potential to boost morale, reduce absences, and even help lower claims costs. Done well, they create a more engaged and resilient workforce.

A well-being survey of more than 2,000 HR leaders showed³:

- 90% of companies tracking return on investment (ROI) from wellness offerings see positive returns

- 75% of employees would consider leaving a company that didn’t focus on their health and wellness

- 85% of Chief Human Resources Officers (CHROs) agree that wellness initiatives help cut costs

What do wellness benefits include today?

Today, wellness benefits are more personalized, flexible, and inclusive than ever before.

They’re designed to support the full spectrum of employee well-being. A modern wellness program meets people where they are, across every dimension of life and work.

Here’s what that includes:

Physical health

Traditional fitness perks like gym reimbursements fall in this category, as well as preventive screenings, nutrition coaching, and wearable fitness devices. The goal is to make healthy habits more accessible and sustainable for every employee, no matter their starting point.

Mental and emotional well-being

Mental health benefits can take many forms, from therapy stipends and meditation apps to stress management programs and paid mental health days. These resources help normalize mental wellness in the workplace and give employees tools to manage challenges before they escalate.

Financial wellness

Being stressed about money can cause major distractions at work. Programs like budgeting tools, student loan assistance, retirement planning, and emergency savings accounts empower employees to feel more secure in their financial lives. And by extension, their overall well-being.

Medical debt is one of the leading sources of financial strain, even for insured employees. When health benefits are more targeted and easier to navigate, employees can avoid surprise costs, reduce out-of-pocket spending, and better protect their financial stability.

Social connection

Wellness thrives in community. Team-building activities, peer recognition programs, volunteer opportunities, and caregiving resources help employees feel more connected to their coworkers and supported in their lives outside of work.

Everyday health and preventive care

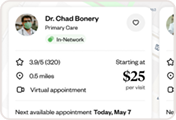

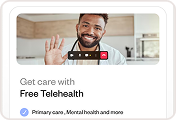

Lifestyle benefits support everyday health choices and early intervention. This can include sleep programs, smoking cessation support, preventive care incentives, and access to virtual primary care. These benefits help employees stay healthier over time and reduce the need for more costly care later on.

Family care

Family-focused benefits recognize that employees don’t leave caregiving responsibilities at the door. Fertility support, parental leave, childcare resources, elder care assistance, and family planning benefits help employees balance work with the realities of caring for others.

The best programs uplift employees across these domains and offer them flexible ways to engage with their benefits.

Where employees could use benefits support in 2026

It’s no secret that we’re living through uncertain times, and employees are feeling that tension.

Employees are especially stressed about their debt, caregiving demands, and hitting their emergency savings goal. While employees want help with their broader financial goals, some employers remain focused on traditional benefits alone.

According to recent research, here are some of the top areas where employees could use support (and what benefits can have the most impact)⁴:

Personal debt

Debt-driven anxiety is taking a toll on employees’ mental state at home and at work. Credit card balances now outpace mortgages, and younger generations are carrying the heaviest burden. Nearly 9 in 10 Gen Z and Millennial workers have some form of debt, and many are balancing multiple financial pressures like student loans, caregiving, and medical expenses.

Benefits that companies can explore: Credit counseling and debt assistance

Caregiver burnout

In general, employees want caregiving benefits to help with time management and work/life balance. Nearly 60% of employees are caregivers, most often supporting a parent or in-law. Caregiving responsibilities are more common among women, younger workers, and those earning the least — adding extra strain to already demanding workloads.

Benefits that companies can explore: Flexible work schedules and personalized caregiver support from platforms like Homethrive

Healthcare costs

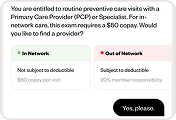

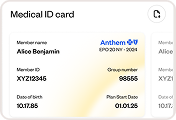

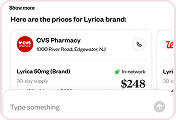

Many employees struggle to understand what care will cost, how to find in-network providers, or how to make the most of their health plans. That confusion leads to delayed care, surprise bills, and higher claims costs for employers.

Benefits that companies can explore: Virtual care or telehealth options and financial wellness programs (e.g., to educate employees about Health Savings Accounts (HSAs) and planning for the future)

Eligibility and tax rules for wellness benefits

Typically, traditional wellness benefits tied to medical care (like smoking cessation or biometric screenings) may qualify as tax-free when integrated with a group health plan. Lifestyle benefits (like general fitness, meditation apps, or massages) often fall into taxable territory unless they’re managed through specific accounts or reimbursements.

Key guidelines:

- Medical-based wellness programs under a group health plan may be exempt from taxation

- Lifestyle spending accounts (LSAs) and stipends used for non-medical expenses are typically considered taxable compensation

- Employers should consult legal/tax advisors or their benefits partners to ensure compliance

Eligible vs. non-eligible activities

To make it clearer, here’s a quick breakdown:

Eligible (tax-free with proper plan design):

- Gym memberships or fitness apps

- Therapy or mental health counseling

- Wellness coaching tied to a health condition

- Smoking cessation programs

Non-Eligible (taxable if offered as cash or LSA):

- Spa visits or massages for relaxation

- General fitness equipment

- Recreational sports leagues

- Hobbies or unrelated activities (e.g., concerts, travel)

5 tips on how to design a high-impact wellness program

A wellness benefit works best when it’s aligned with your company culture and employee needs. Here’s how to approach design with intention:

1) Start with a survey

Before you roll out a new program, ask employees what they actually want. Use a short, anonymous survey to learn which wellness areas they care most about (e.g., fitness, mental health, nutrition, financial wellness, or caregiving options).

2) Define your goals

The most impactful wellness programs are often tied to a clear objective. Are you trying to reduce burnout, improve retention, or increase engagement? Defining the “why” behind your program will help you prioritize where to invest and how to measure success.

3) Offer flexibility

Every employee’s version of “wellness” is different, so your benefits should reflect that. Let employees personalize their experience through flexible options like a wellness stipend, LSAs, or a menu of program choices. Flexibility increases participation and helps employees feel seen.

4) Communicate clearly

Use email, intranet posts, Slack channels, or even manager one-on-ones to inform people about your benefit offerings. Be consistent, keep it simple, and remind employees what’s available during key moments (such as open enrollment) and throughout the year.

5) Revisit and adjust

Employee needs can change from year to year, and with healthcare costs being as high as they are, it’s important to handle benefits efficiently. Take note of what benefits your team is actually using, and make adjustments as needed. Regular feedback and usage data can help you evolve the program over time to stay relevant and cost-effective.

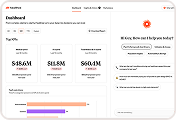

Measuring return on investment

Speaking of making strategic adjustments, here are key metrics you can track to know if your wellness benefit is working:

- Participation rates in wellness programs or stipends

- Changes in absenteeism or productivity metrics

- Progress with engagement or satisfaction survey results

- Claims data for preventable or stress-related conditions

Link these outcomes to strategic goals, and you’ll have a business case leadership can stand behind.

How technology boosts wellness benefit engagement

Wellness programs are successful when employees know how to access and use them.

Here’s how modern technology helps ensure employees feel confident and encouraged to engage with their benefits:

Accessibility

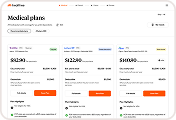

Wellness benefits should be easy to find. Centralized platforms give employees a single location to view wellness stipends or balances, schedule services, and access all available programs without needing to log into multiple systems. When benefits aren’t fragmented, employees are more likely to use your company’s resources.

Education

Even the most generous benefits go underused if employees don’t understand them. Digital tools can send timely reminders, personalized nudges, and AI-driven recommendations tailored to each employee’s needs. Those touchpoints foster more relevant engagement and a better employee experience.

Tracking

Visibility is key to improvement. Built-in analytics show HR teams which programs are being used, which aren’t, and where adjustments can create more value. Tracking participation trends over time also helps demonstrate ROI and guide future strategy.

Platforms like Healthee bring all three together by giving employees one place to access their benefits, receive AI-powered guidance through Zoe, and give HR teams clear insight into engagement and impact.

Future trends for wellness benefits

Looking ahead, wellness benefits are becoming even more personalized, tech-integrated, and inclusive. Here’s what’s trending:

- AI-powered wellness guidance: Employees receive customized advice based on behavior, health goals, or life stage

- Preventive-first program design: Employers are doubling down on early interventions instead of reactive care

- Inclusive well-being: Expect to see more support for caregivers, neurodivergent employees, and diverse cultural definitions of wellness

- Financial wellness expansion: Tools that assist with budgeting, saving, and even retirement-readiness are growing fast

Make wellness a strategic priority

Although some companies might be tempted to drastically cut back on wellness benefits in today’s economic climate, leading employers will instead make their programs more targeted and accessible.

With the right tools and guidance, wellness benefits can drive healthier teams, happier employees, and smarter cost control year after year.

If you’re looking for an effective way to simplify benefits, boost engagement, and cut health spend, reach out to our team! Let’s talk about how Healthee can support your strategy.