Telehealth has evolved from a convenience to a cornerstone of modern benefits strategies. That’s why the recent federal legislation extending no-cost telehealth access for individuals enrolled in high-deductible health plans (HDHPs) is a critical regulatory update.

Under the Further Consolidated Appropriations Act, 2024 (H.R. 2882), employers offering HDHPs can continue to provide telehealth services before the deductible is met without affecting their employees’ health savings account (HSA) eligibility. This provision, found in Division N, Title I, Section 110 of the law, preserves “first-dollar coverage” for telehealth through the end of 20241.

This update builds on a series of extensions that began during the COVID-19 Public Health Emergency, when the CARES Act first made remote care pre-deductible for HDHP members. Originally intended as a short-term response, this flexibility has become a fixture of thoughtful benefits design2.

This new provision supports equitable care access and helps employers maintain cost-effective, competitive benefits. In this post, we break down what the policy change means, why it matters for HR leaders and brokers, and how Healthee helps employers make the most of it.

What Does the Telehealth Policy Change Do?

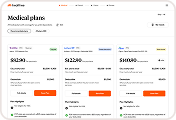

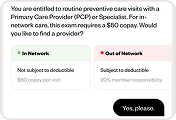

High-deductible health plans (HDHPs) are widely adopted by employers for their budget-friendly structure and HSA eligibility. But the trade-off often lies in delayed care, especially when employees must meet high deductibles before coverage begins.

Historically, HDHPs couldn’t offer first-dollar coverage for services like telehealth without compromising HSA eligibility. That changed with the CARES Act in 2020, which introduced a temporary fix during the pandemic. Since then, Congress has repeatedly extended this flexibility — most recently through the end of 2024 with the passage of H.R. 2882.

With this telehealth policy change, HDHP members can now continue accessing telehealth services, including both physical and mental health support, without having to first meet their deductible.

Why it matters for employees: Nearly 30% of adults with HDHPs delayed or avoided care in the past year due to high out-of-pocket costs3. Telehealth access has been a crucial stopgap for many Americans. Removing these financial barriers ensures more timely and preventive care, which ultimately benefits both employees and employers.

Why This Matters for Employers and HR Leaders

For HR leaders, people teams, and brokers, regulatory shifts often signal new requirements. But occasionally, they also open the door to meaningful change. The extension of no-cost telehealth access for HDHP members is exactly that: a moment where compliance and competitive advantage converge.

While adhering to the law is essential, the real value of this provision lies in how it can be used to strengthen benefits strategy, drive cost efficiency, and improve the employee experience.

Preserve HSA Eligibility While Enhancing Access

One of the core concerns with HDHP design is the balance between cost containment and access. Employers often lean on HDHPs for budgetary reasons and to support health savings account (HSA) offerings, but that structure can unintentionally delay care.

This new policy provision allows employers to maintain HSA eligibility while offering first-dollar coverage for telehealth. That means employees can now get the care they need without first paying out-of-pocket, and employers can retain the tax advantages of HDHP-HSA pairings. It is a win-win that reduces employee hesitation without compromising financial incentives.

Promote Early Intervention and Preventive Care

By removing the deductible barrier, this legislation encourages earlier engagement with care. Employees are more likely to seek virtual visits for minor symptoms, chronic condition management, or follow-up care when they know it will not cost them upfront.

This shift toward timely intervention can prevent costly complications and reduce emergency department usage, which in turn drives down claims costs for employers. Encouraging care at the right time and in the right setting is one of the most effective levers for long-term cost control. Wider telehealth access ensures employees will find that well-timed care.

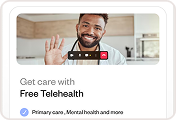

Sustain Affordable Mental Health Support

Mental health access is no longer a nice-to-have. Today’s workers are expecting mental health benefits and support as a foundation of the employee-employer contract. The pandemic-era extension of mental health teletherapy without a deductible ensures HDHP-enrolled employees can continue receiving virtual counseling, therapy, and psychiatric support at no cost to them.

This is especially critical in a modern work environment where stress, anxiety, and burnout remain high. By preserving first-dollar mental health coverage, employers show they are prioritizing emotional well-being, which directly impacts productivity, engagement, and retention.

Elevate Your Benefits Narrative in a Competitive Talent Market

Today’s candidates and employees care deeply about benefits. But they also care about how easy those benefits are to access and use. Offering telehealth services at no cost removes a barrier that employees feel directly.

This is a powerful story for talent acquisition and retention. Employers can enhance their benefits package without adding cost, providing a richer employee experience that sets them apart from competitors. For brokers advising clients, this is a compelling value proposition to bring to renewal conversations and strategic planning.

How Healthee Makes It Easy to Activate

The best policies are the ones people can actually use. That is where Healthee comes in. While legislation can remove structural barriers, it takes the right tools to ensure those benefits are fully accessible, well-understood, and used at the right moments. Healthee’s platform is purpose-built to bridge that gap, turning policy into progress for employers and employees alike.

Whether you are an HR team implementing a compliant benefits strategy or a broker advising clients on optimizing their offerings, Healthee makes it simple to deliver on the promise of no-cost telehealth access. Here’s how:

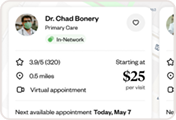

1. Embedded Telehealth, Fully Integrated

Healthee gives employees direct access to telehealth services from within a single platform. There is no need to switch between apps, search provider directories, or remember login credentials. Once enrolled, employees can instantly book and attend virtual visits in just a few clicks.

By embedding telehealth directly into the benefits experience, Healthee removes friction and increases adoption, key for ensuring employees actually take advantage of first-dollar coverage. Medical and mental health visits are both supported.

2. 24/7 AI-Powered Benefits Support

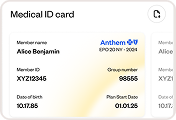

Understanding benefits is often the biggest hurdle to using them. That is why Zoe, Healthee’s in-app AI assistant, is available 24/7 to answer questions in plain language.

From “Is telehealth covered under my plan?” to “What does this visit cost me?” Zoe delivers real-time, personalized answers so employees can make informed care decisions on the spot. It is like having a virtual benefits guide in your pocket, empowering employees without adding administrative strain on HR.

The best part? Zoe can help employees remember and engage with their free-to-use telehealth, even if they’re part of the HDHP population.

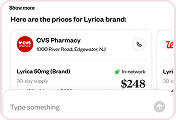

3. Smart Navigation Toward Cost-Effective Care

One of Healthee’s most impactful features is its behavioral steering engine. By analyzing coverage, cost, and clinical need, the platform proactively guides users toward appropriate, lower-cost options, like telehealth, instead of higher-cost sites of care such as the emergency room or urgent care centers.

This functionality is not just about convenience. It helps employers manage costs while promoting preventive and early-stage care, aligning with the spirit of the federal provision and reducing downstream claims.

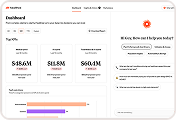

4. Real-Time Benefits Intelligence for HR and Brokers

For HR leaders and brokers, the ability to track benefits engagement, utilization trends, and care patterns is critical for both compliance and long-term planning. Healthee provides telehealth analytics on how employees are using their telehealth benefit, including telehealth-driven pharmacy utilization.

This insight allows employers to optimize benefits strategy proactively, identifying opportunities to educate, adjust, or expand offerings based on actual behavior, not guesswork. Brokers can use this data to support renewal conversations and demonstrate ROI to clients.

Turning Policy Into Progress

This recently passed law preserved telehealth access, but it is up to employers to make it actionable. With platforms like Healthee, care becomes simpler, faster, and more cost-effective for everyone involved.

By leaning into this moment, employers and brokers can continue to raise the bar for the employee benefits experience. It is a clear path forward, not just in compliance, but in care.

References:

1. U.S. Congress. (2024). Further Consolidated Appropriations Act, 2024, H.R. 2882, Division N, Title I, Sec. 110. https://www.congress.gov/bill/118th-congress/house-bill/2882

2. U.S. Department of the Treasury. (2020). Notice 2020-15: High deductible health plans and expenses related to COVID-19. https://www.irs.gov/pub/irs-drop/n-20-15.pdf

3. KFF. (2023). Health care debt in the U.S.: The broad consequences of medical and dental bills. https://www.kff.org/health-costs/report/kff-health-care-debt-survey/

Disclaimer: This blog post is intended for informational and educational purposes only. Healthee does not provide legal, tax, or financial advice. Readers should consult with their legal or benefits advisors to understand how federal policy changes may apply to their specific situation.