Choosing the right partner to administer your employee health benefits is more important than ever. As healthcare costs rise and workforce needs become more complex, many employers are turning to medical third‑party administrators (TPAs) to help manage claims, control costs, and deliver better benefits administration.

But not all TPAs are created equal.

In this post, we’ll break down what employers should know about TPAs and the five areas to evaluate as you explore partnerships in 2026 and beyond.

What is a medical third‑party administrator (TPA)?

A medical third‑party administrator (TPA) is an independent organization that handles the administrative tasks involved in managing self-funded health plans, acting as a liaison between employers and healthcare providers without taking on the financial risk of claims. While they offer incredible value to self-funded groups, you may also find TPAs working with level-funded organizations.

TPAs handle tasks like processing claims, overseeing provider networks, and ensuring regulatory compliance. Think of them as an operational backbone that manages the “how” of benefits (rather than “who” is paying for the care itself).

About 67% of covered workers are enrolled in self-funded plans,¹ which is where employers pay employee medical claims themselves rather than pay fixed premiums to a commercial insurer. This gives employers more flexibility and a chance to save money, but it also adds more administrative challenges to their plates.²

Enter: TPAs.

Why employers choose to work with TPAs

Here are some of the top reasons why employers work with medical third-party administrators, especially large businesses and those with diverse healthcare needs:

Cost control and flexibility

For employers willing to take on financial risk through self‑funding, TPAs offer a way to tailor plan designs to meet your workforce’s specific needs. Without the fixed premium of fully insured policies, employers can enjoy greater control over benefit structures while retaining flexibility in provider networks and cost‑management strategies.

Administrative relief

Managing a health plan internally requires a significant amount of infrastructure. TPAs take on the operational burden of claims adjudication, member services, provider negotiations, and compliance tracking — freeing HR teams and benefits leaders to focus on other core priorities rather than day‑to‑day administration.

Enhanced expertise

TPAs typically specialize in health plan management and have ample experience with regulatory requirements, claims complexity, and network arrangements. This expertise can help create smoother plan operations and better outcomes for both employers and employees.

Core services you can expect from medical third-party administrators

Before selecting a TPA partner, it’s important to understand their standard services. Not all TPAs offer the same suite of capabilities. As you review this list, think about which services would be most valuable to your team.

Claims processing and adjudication

TPAs handle the full lifecycle of medical claims, from receipt and verification to payment and dispute resolution. This includes eligibility verification, claims auditing, preventing overpayments, and ensuring plan rules are being followed.

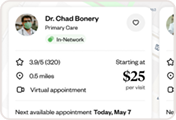

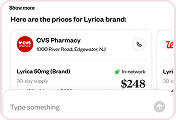

Network access and management

Many TPAs coordinate access to provider networks, negotiate rates, and oversee contracts with hospitals, physicians, and ancillary care providers. This network management work helps employees get the care they need without driving up claims costs.

Stop‑loss coordination

While TPAs don’t take on insurance risk themselves (only the plan sponsor bears the risk), they work closely with stop‑loss carriers to help protect employers from unexpectedly high medical claims.

Compliance support

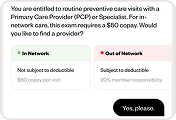

TPAs help employers comply with major federal regulations such as the Employee Retirement Income Security Act (ERISA) and the Affordable Care Act (ACA) requirements, ensuring proper documentation and reporting.³

Customer service and member support

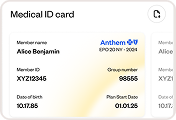

A quality TPA provides support portals, call centers, and tools for employees to find answers to claims questions, eligibility issues, and benefits details.

Who should consider a TPA?

TPAs are not one‑size‑fits‑all, but they make sense for employers with certain profiles:

- Self‑funded and level‑funded employers: Organizations choosing to self‑fund, either directly or through level‑funded arrangements, almost always partner with TPAs because these administrators handle the complex daily plan operations that in‑house teams are ill‑equipped to manage.

- Larger workforces with complex benefits: Employers with diverse, multi‑state, or high‑utilization populations benefit from the flexible plan design and specialized capabilities TPAs offer. TPAs can present plan designs tailored to your workforce’s unique needs, including tiered provider networks, carved-out pharmacy benefits, or expanded mental health coverage.

- Organizations seeking more control: If maintaining control over claims costs, network contracts, and benefit design is a priority, a TPA partnership could work in your favor. Employers would have more power compared to a traditional insurer arrangement, which might lock you into pre‑packaged solutions.

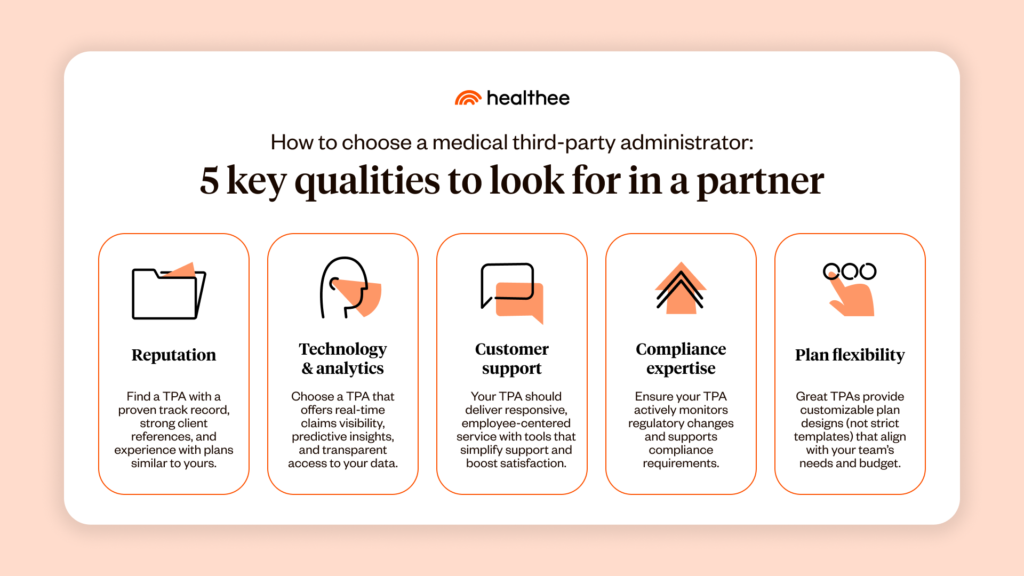

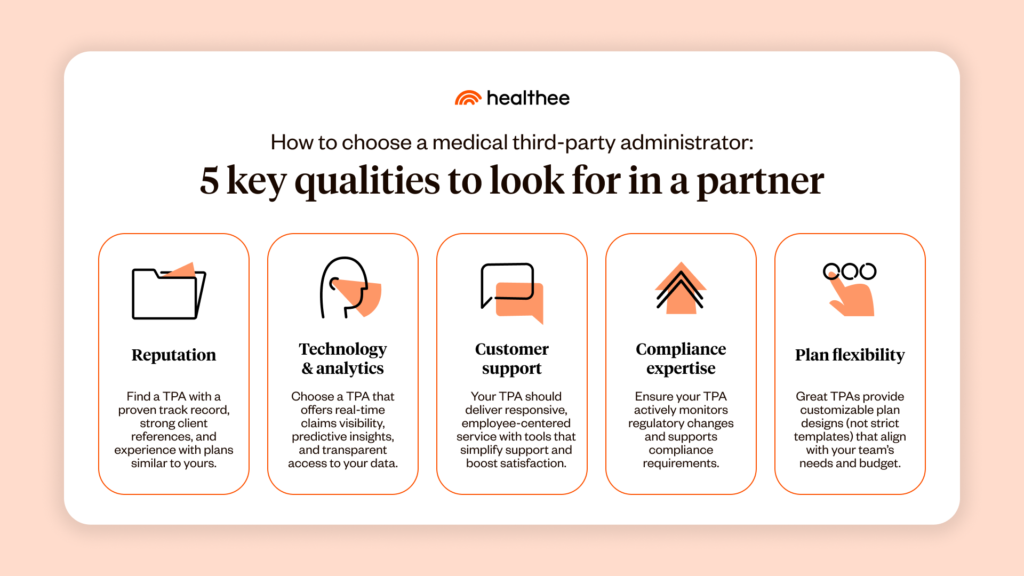

How to choose a medical third-party administrator: 5 key qualities to look for in a partner

Selecting a TPA is a strategic move that can improve cost efficiency, streamline plan administration, and enhance your employees’ experience. The right TPA becomes a trusted extension of your team.

Here are five qualities to prioritize as you evaluate potential partners:

1. Reputation and track record

Start by evaluating a TPA’s performance history with plans that were similar to your own (in size and complexity). Look for consistent claims accuracy, strong client testimonials, and references from employers in your industry.

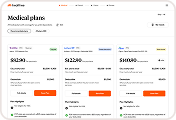

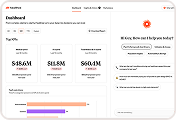

2. Technology and analytics capabilities

Modern health plan administration relies on data. Not guesswork. A TPA with advanced analytics and reporting tools can help your organization identify usage trends, forecast costs, and make smarter design decisions. Interactive dashboards, real‑time claim visibility, and predictive insights are differentiators in the market. You’ll also want to make sure that access to your claims data and analytics is standard with your TPA partner, and they share information transparently.

3. Customer service and engagement

TPAs should act as extensions of your HR team — responsive, communicative, and employee‑centric. Ask about average call response times, escalation processes, and how the TPA supports employee education and resolution workflows. Also, inquire about the member-facing AI tools at their disposal and how navigational support increases member satisfaction.

4. Regulatory and compliance expertise

With ongoing changes in federal and state regulations, your TPA needs to provide robust compliance support. This includes tracking policy changes, advising on ACA reporting requirements, and supporting ERISA fiduciary standards.

5. Flexibility and customization

Top TPAs don’t force employers into rigid templates. They offer customizable plan design, network choices, and stop‑loss options that align with your benefits strategy and budget goals.

Understanding typical costs and fee structures

The amount you pay TPAs can range widely depending on the scope of their services and the size of your company.

Common fees

- Per employee per month (PEPM): This is the most common and transparent model, where an employer is charged a fixed monthly fee for each employee covered by the health insurance plan.

- Per-claim fees: Some TPAs, particularly for larger self-funded plans, may charge based on the number of claims processed or a percentage of claims paid.

- Setup and implementation fees: You might be charged a one-time setup fee when first establishing the plan with a TPA, which can range from a few hundred to over a thousand dollars, depending on the complexity of the plan and the number of employees.

TPAs might charge extra for services such as:

- Stop‑loss insurance: Fees associated with coordinating and managing an employer’s stop-loss insurance, which protects your team from catastrophic claims.

- Integrations: There may be additional setup or maintenance fees if your TPA integrates with broker systems, HR tech stacks, or benefits navigation tools like Healthee.

TPA trends we’re noticing in 2026

The TPA landscape is evolving quickly. Employers should look for partners who embrace emerging trends that can improve efficiency and the employee experience:

Automation and AI

From automated claim adjudication to digital member support, AI is reducing administrative burden and improving accuracy. Employers should seek TPAs with intelligent automation in workflows and customer service.

Predictive analytics

Advanced TPAs use data to forecast utilization and cost trends, helping employers make proactive plan design decisions rather than reactive adjustments.

Integration with digital health

Digital health tools — including telemedicine, remote monitoring, and personalized navigation assistants — are becoming standard components of modern benefits. TPAs that integrate with these technologies can help employers deliver a more seamless benefits journey.

For example, platforms like Healthee represent the trend toward AI‑driven benefits technology that supports both administrative efficiency and employee comprehension. By linking TPA data with employee support tools, employers can inspire better plan usage and improve people’s satisfaction.

Interested in working with a TPA?

Medical third-party administrators are strategic partners in managing your organization’s health plan operations. With the right TPA partner, employers can deliver better benefits outcomes, streamline administration, and help employees get more value from their healthcare plans.

Next steps you can take as an HR leader:

- Define your goals. What do you need from a TPA in terms of service quality, data insights, and customization?

- Audit your current benefits performance. Identify gaps in cost, utilization, and employee satisfaction.

- Request detailed proposals. Ask candidates for demo access to portals, sample reports, and client references.

- Assess integrations. Consider how TPAs work with technology partners like Healthee to enhance employee understanding.

If you’d like to learn more about how Healthee’s platform makes health care navigation easy for employees, we’d be happy to connect.