For self-funded employers, managing healthcare claims can be complex and time-consuming. From verifying employee coverage to ensuring compliance with regulations, the claims adjudication process requires expertise, efficiency, and accuracy. That’s where Third-Party Administrators (TPAs) step in.

TPAs handle claims processing, cost containment, compliance, and provider coordination—allowing employers to focus on strategic benefits management rather than administrative burdens.

In this blog, we’ll break down:

- What claims adjudication is and why it matters

- The critical role TPAs play in the process

- How TPAs help employers control costs and improve the employee benefits experience

What Is Claims Adjudication?

Claims adjudication is the process of reviewing and processing healthcare claims submitted by providers, hospitals, and pharmacies to determine payment eligibility under an employee’s health plan.

Key Steps in the Claims Adjudication Process

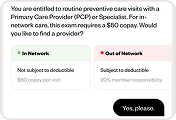

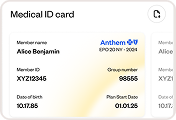

- Checking Coverage Eligibility: Verifying whether the medical service is covered under the employee’s health plan.

- Validating Claim Details: Reviewing provider information, diagnosis codes, and treatment details for accuracy.

- Applying Plan Rules: Calculating deductibles, copays, and coinsurance amounts to determine payment responsibility.

- Approving or Denying Claims: Deciding whether the employer or insurer should cover the cost, or if additional information is required.

Without a well-managed adjudication process, employees face delayed reimbursements, billing errors, and unexpected out-of-pocket costs—ultimately hurting their healthcare experience.

How TPAs Enhance Claims Adjudication for Self-Funded Employers

1. TPAs Handle Claims Processing with Speed and Accuracy

For self-insured employers, TPAs manage claims adjudication by:

✔ Ensuring fast and accurate claims processing

✔ Reducing billing errors and fraudulent claims

✔ Managing reimbursements efficiently

By outsourcing claims processing to a TPA, employers can ensure compliance and efficiency while avoiding costly administrative overhead.

2. Applying Plan Rules and Containing Healthcare Costs

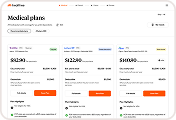

TPAs act as gatekeepers for employer-sponsored health plans, ensuring that claims align with the plan’s structure and cost-saving strategies. This includes:

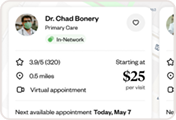

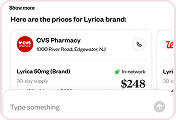

✔ Verifying in-network vs. out-of-network provider status

✔ Applying cost-sharing mechanisms (deductibles, copays, coinsurance)

✔ Steering employees toward lower-cost care options

✔ Preventing unnecessary procedures or overbilling

By controlling healthcare spend, TPAs help self-funded employers maximize their ROI on health benefits.

3. Coordinating with Providers and Insurers

TPAs streamline communication between employees, healthcare providers, and insurance carriers by:

✔ Managing claim approvals and denials with providers

✔ Handling claim disputes and appeals on behalf of employers

✔ Negotiating payment terms with healthcare providers when needed

This reduces friction in the claims process and ensures employees receive the care they need without delays.

4. Ensuring Compliance with Healthcare Regulations

Claims adjudication must follow strict regulatory guidelines, including:

- HIPAA (Health Insurance Portability and Accountability Act): Protecting employee health data.

- ERISA (Employee Retirement Income Security Act): Governing employer-sponsored benefits.

- ACA (Affordable Care Act): Ensuring essential health benefits compliance.

TPAs help employers navigate legal complexities and avoid penalties by ensuring claims are processed in accordance with industry regulations.

5. Leveraging Technology and AI for Smarter Claims Management

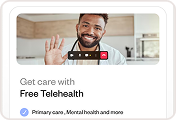

Modern TPAs use AI-powered claims automation to:

✔ Reduce manual errors and processing delays

✔ Provide real-time claim status tracking for employees

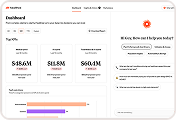

✔ Offer predictive analytics to help employers optimize their benefits strategy

By integrating with AI-driven platforms like Healthee, TPAs can further enhance claims transparency, efficiency, and employee experience.

The Employer and Employee Benefits of Working with a TPA

The Benefits for Employers

✔ Reduces administrative burden and allows HR teams to focus on strategy

✔ Lowers healthcare costs by enforcing plan rules and cost controls

✔ Improves compliance with federal and state healthcare regulations

✔ Provides real-time data on claims trends and utilization

The Benefits for Employees

✔ Faster claim approvals and reimbursements

✔ Less confusion about what’s covered and what’s not

✔ Improved access to care by reducing claim denials and delays

✔ Greater transparency in healthcare costs and out-of-pocket expenses

Final Thoughts: Why TPAs Are Essential for Modern Benefits Management

For self-funded employers, managing healthcare claims efficiently is not optional—it’s essential. TPAs play a critical role in claims adjudication, cost control, compliance, and employee satisfaction.

As healthcare costs continue to rise, choosing the right TPA and leveraging AI-powered benefits platforms like Healthee can make a significant impact on both cost savings and employee well-being.

Looking to optimize your claims processing and benefits experience? Book a meeting with us!