When you hear the term “benefits broker,” you might picture someone who shops for quotes once a year, emails you a spreadsheet, and helps you pick the best plan based on price and coverage. But in today’s healthcare landscape, brokers are evolving into something more: benefits advisors.

Rising healthcare costs, complex regulations, and growing employee expectations have shifted what employers need and what top-performing brokers deliver.

The best brokers today aren’t just looking for plans around renewal season. They’re building multi-year strategies, using data to manage risk, and integrating technology to help employees actually understand how to use their benefits.

Here’s an overview of what benefits advisors do, and how they can help your team reduce costs, save time, and deliver a better experience to every employee.

What do benefits advisors actually do?

A benefits advisor is a long-term partner who helps HR and finance leaders get the most out of their healthcare investment. Think of them as an extension of your team who truly understand your company’s goals, challenges, and workforce needs.

While they still help you choose plans and negotiate renewals as traditional benefits brokers do, advisors go far beyond that. They guide strategy, mitigate risk, and consistently support your employees.

Here’s what that looks like:

Strategic, long-term planning

Great advisors don’t think in 12-month cycles. They develop multi-year roadmaps that align with your organization. This might include evaluating whether to remain fully insured or explore level funding, forecasting utilization trends, or introducing new point solutions to enhance employee well-being.

Compliance and risk management

From ACA reporting to COBRA and state-specific rules, compliance isn’t optional — and it’s constantly evolving. Advisors help HR teams navigate changing regulations while minimizing administrative burden and exposure to penalties. They also help prepare you for audits and assist with documentation and filings.

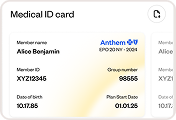

Employee advocacy and support

Benefits advisors work for you, not the carrier. That means they’re often the first point of contact when an employee runs into a billing issue or can’t get a claim resolved. They advocate for your people, and by doing so, help build trust in your benefits program (which boosts retention and morale).

Why benefits advisors are a key partner in today’s landscape

The reality for HR teams today is that benefits decisions no longer sit in a neat box. Health benefits impact recruiting, retention, productivity, culture, and cost control simultaneously.¹

Benefits advisors help connect those dots. They bring a broader perspective that accounts for business goals, workforce demands, and financial pressure — instead of treating benefits as a once‑a‑year administrative task.

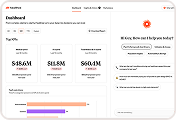

Bridging the Gap: Aligning HR Goals with CFO Priorities

One of the most critical roles of a modern benefits advisor is acting as a translator between HR and Finance. While HR focuses on talent attraction and employee wellbeing, the Finance team focuses on predictable spend and ROI.

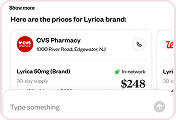

A tech-powered advisor uses real-time data to show how a better employee experience actually reduces the bottom line. By identifying high-cost drivers and implementing AI-driven navigation, an advisor helps HR deliver the “Gold Standard” of care while giving the CFO the cost-containment metrics they require.

The cost of not meeting expectations

Employee expectations have changed. People want benefits that feel intuitive and digital-first, similar to the tools they use in every other part of their lives. A recent survey showed that 72% of employees value digital platforms that provide easy access to benefits information and enrollment tools, highlighting the demand for user-friendly technology.²

When employees are confused about coverage, providers, or costs, that confusion shows up as:

- Delayed or avoided care

- Higher claims from inappropriate usage

- More questions landing in HR’s inbox

Benefits advisors help close that gap by pairing plan design with education, communication, and ongoing support, so employees can actually use what employers are offering.

Keeping up with the healthcare industry

Just as importantly, advisors help employers stay proactive in a fast‑moving benefits space. A strong advisor keeps HR leaders informed and prepared. They bring options forward before problems have a chance to surface. Instead of reacting to rising costs or employee dissatisfaction after the fact, employers can make smarter adjustments sooner, with confidence.

Benefits advisors are essential partners for organizations that want to manage healthcare responsibly while championing the people who rely on it every day.

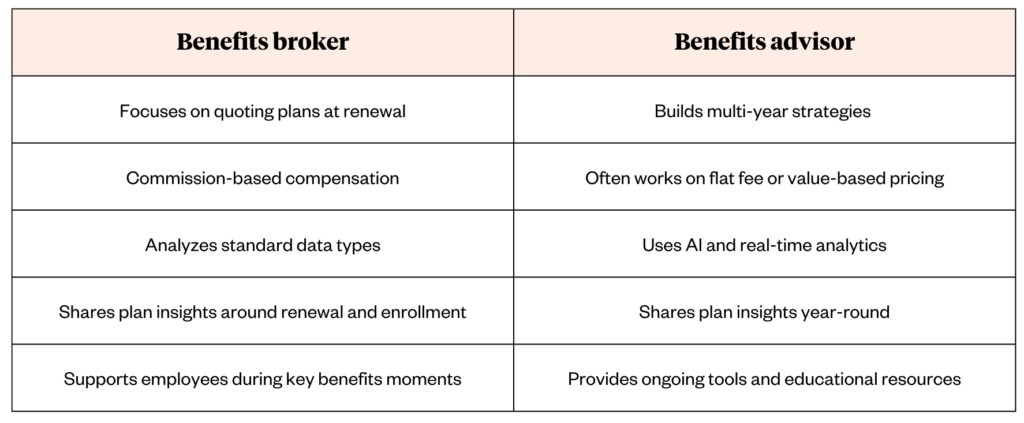

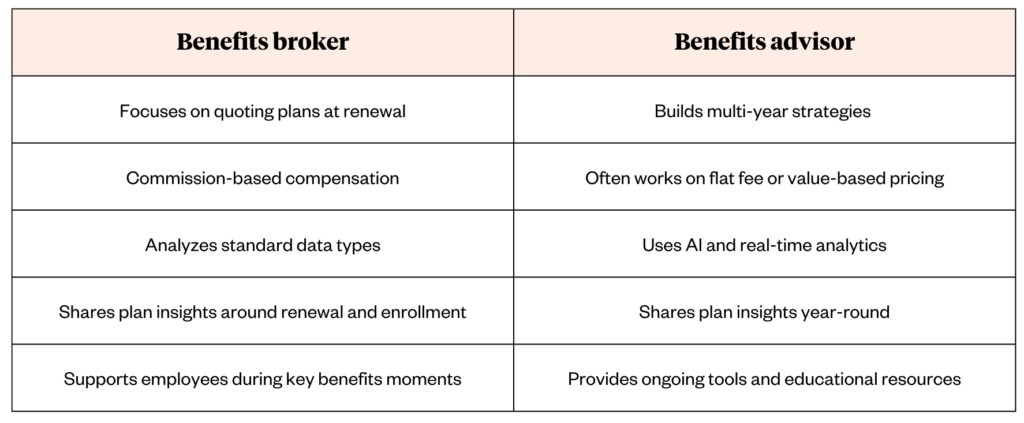

Benefits advisor vs. benefits broker: What’s the difference?

Plenty of benefits advisors are licensed brokers, but they approach their work in different ways.

Here’s a look at how the two approaches typically differ:

While both can help you secure quality coverage, advisors take it a step further by offering continuous support and advanced insights.

Transparency in Compensation: Fees vs. Commissions

When moving from a broker to an advisor, the conversation around “how they get paid” changes.

-

Traditional Brokers: Often rely on carrier commissions, which can sometimes create a “status quo” incentive.

-

Strategic Advisors: Frequently move toward a flat-fee or performance-based model.

This shift ensures your advisor’s only incentive is your company’s success, not the size of your premium. If you are looking for an advisor, always ask for a full disclosure of their compensation structure to ensure 100% alignment with your financial goals.