We just rang in the new year, but planning season is already in full swing. Over the next few months, you’ll be deep in conversations with your broker to shape your 2027 benefits strategy.

It’s the same cycle every year: premiums go up, networks shift, and everyone crosses their fingers that the new plan will be “easier to understand” or “better utilized.” But this year, along with a staggering rise in healthcare costs, we’re facing a fundamental shift in how employees expect to engage with their benefits.

AI can address both of those challenges head-on. It’s already proven to drive better employee experiences and measurable cost savings for employers. If your broker isn’t advocating for AI as part of your benefits strategy, then you need to ask one simple question:

Why not?

Cost savings are essential for 2027 planning

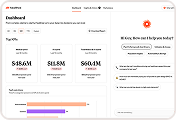

Employers are facing sustained increases in medical spend, pharmacy costs, and specialty care utilization. Most finance leaders would probably agree that traditional cost containment strategies alone won’t be enough over the next few years. There are many ways AI can help you reduce costs, including making voluntary benefits more visible, improving cost predictability, and refining claims management.

When employees are guided to the right plan, the right provider, and the right care setting, costs come down. When your team has transparent insight into what’s driving claims, you can act quickly and see real improvements.

Healthee’s AI platform delivers insights via advanced fraud, waste, and abuse (FWA) detection and claims analytics for employers. Our AI engine scans historical claims data to surface billing errors and high-impact anomalies that standard audits often miss, including duplicate charges, overbilling, unbundled procedures, pharmacy waste, and provider abuse. Each finding is reviewed by licensed clinicians and coordinated directly with TPAs and providers to recover dollars back to the plan.

With a pay-for-performance model and no added workload for HR teams, these capabilities give employers a practical way to move from reactive cost management to proactive savings as they plan for 2027.

Healthcare complexity isn’t going away in 2027, but AI is transforming how we navigate it

As 2027 strategy conversations ramp up, one thing is clear: healthcare isn’t getting simpler, but employees want it to feel effortless.

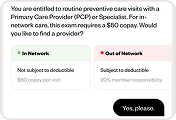

The truth is, benefits are confusing for everyone. I’ve seen it firsthand with our clients at Healthee: even highly educated, well-resourced teams struggle to explain what coinsurance means or whether a specialist visit will be covered. When employees don’t understand how to use their health coverage, they avoid care or overspend on it. Both of which drive up long-term costs for your business.

An important data point we noticed in our recent benefits report is that over 21% of 2026 enrollees are digital-native, insurance-unaware Gen Zers. They expect a modern, proactive experience. When they don’t get it, they go elsewhere. Many are already using unsecured, non-personalized AI tools like ChatGPT to answer healthcare and benefits questions.

The risk? ChatGPT doesn’t know your plan design, so any contracts or point solutions you have in place to save money won’t be considered. The chatbot will give inaccurate, costly guidance to your employees.

On top of that, ChatGPT isn’t a private platform, which means there could be potential data exposures. As an employer, the time to get ahead of this is now — by giving employees the intelligent, secure tools they’re already looking for.

When you add purpose-built AI to your strategy, healthcare navigation becomes smarter, safer, and more aligned with how your workforce wants to engage.

The best AI-powered platforms today are delivering:

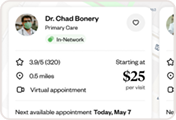

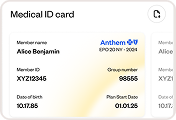

- Hyper-personalized support. AI-powered platforms deliver tailored experiences based on each employee’s health profile, household dynamics, and care preferences. They also surface relevant recommendations and reminders exactly when they’re needed. This level of personalization should be the new standard.

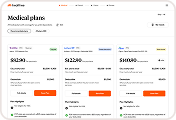

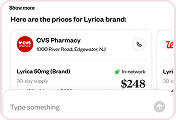

- Guided plan comparisons. Instead of choosing based on guesswork or monthly premiums alone, employees are guided through plan selection with scenario-based insights that show how each plan performs based on real-life situations.

- Built-in cost containment. Detect underused features, redirect care to more efficient options, and reduce unnecessary spend (no complex manual analysis from HR or finance teams needed). Cost-savings are an absolute must-have.

- Centralized, accessible resources. Instead of jumping between carrier portals, PDFs, or call centers, employees get instant explanations in one place — whether they’re choosing a provider, tracking deductible progress, or preparing for a procedure.

- Faster answers. AI assistants can respond to common questions 24/7, freeing your HR team to focus on strategic work instead of fielding the same questions each week.

AI will be one of the most strategic tools HR can implement in 2027 to meet employee expectations while keeping costs in check.