Health insurance is one of the most important investments an organization will make. And if you’re a small business, navigating that investment can feel especially complex.

With fewer internal resources and limited negotiating power, dealing with health insurance benefits quickly becomes overwhelming. Rising costs, tricky compliance rules, and evolving employee expectations only add to the pressure.

That’s where the right health insurance brokers for small businesses come in. Not just to quote plans, but to serve as your advisor, guide, and strategic partner.

But how do you know if a broker is actually the right fit?

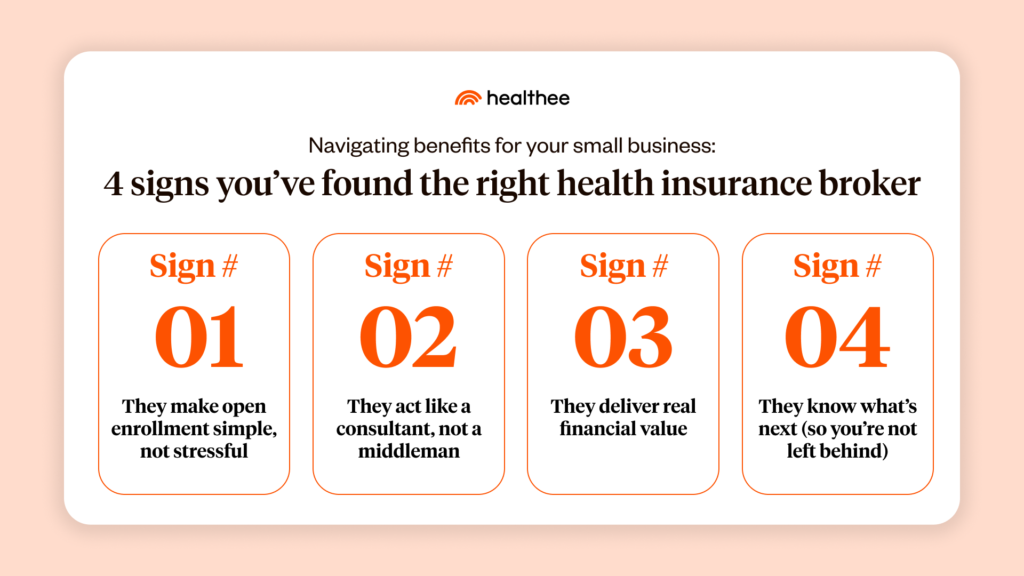

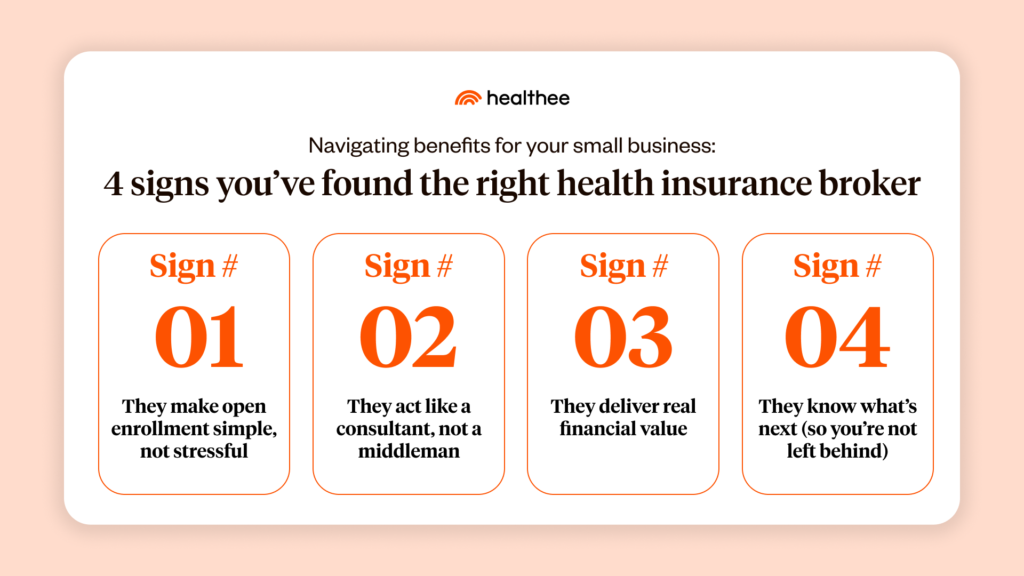

Whether you’re evaluating your current partner or exploring options for the first time, here are four clear signs you’ve found a broker who’s truly aligned with your business needs — now and for the long haul.

Why small businesses need a health insurance broker

Offering health insurance is no longer optional if you want to attract and retain great talent, even as a smaller employer. But plan selection, contribution strategies, compliance, and employee education all add up to a heavy lift.

For small businesses without a full-time benefits expert on staff, a broker can help fill that gap with the knowledge, resources, and support your team needs. They bring the expertise and market access needed to help you build a plan that fits your budget, your workforce, and your growth goals. A survey showed that about 88% percent of small employers purchased or renewed their employer-sponsored health insurance through an agent or broker.¹

And as employee expectations rise — with more demand for personalization, digital access, and mental health support — having a broker who can help you adapt quickly is a necessity.

What a broker actually does for small businesses

A common misconception is that brokers simply help you pick a health plan once a year.

In reality, the right broker serves as an embedded partner. One that supports your HR, finance, and leadership teams in building a benefits strategy that aligns with your organization. They provide professional guidance not just on cost, but on how your plan design supports retention, compliance, and long-term progress.

Beyond selecting plans, a strong broker helps you think ahead. They bring market insights, advocate for your business during renewals, and help you adapt as your needs evolve — whether that means exploring self-funding, evaluating new point solutions, or responding to regulatory changes.

Most importantly, they show up year-round (not just at open enrollment), acting as a steady resource in a benefits landscape that rarely stays still.

The top benefits of working with a broker

Before we dive into the four signs you’ve found a great health insurance broker for small businesses, it’s worth highlighting some of the core advantages:

Cost savings

As healthcare spending continues to climb, managing costs will be a top priority this year. A broker helps control spend through smarter plan design, better carrier selection, and active negotiation on your behalf.

Time efficiency

By managing enrollment, vendor coordination, and employee questions, brokers significantly reduce HR’s workload throughout the year.

Plan renewals

Brokers give you access to multiple carriers and provide side-by-side comparisons so you can make informed plan renewal decisions with confidence.

Ongoing support

A strong broker supports you year-round by helping resolve claims issues, educating employees, and navigating compliance requirements.

4 signs you’ve found the right health insurance broker

Sign #1: They make open enrollment simple, not stressful

For many small businesses, open enrollment (OE) is one of the most time-consuming (and high-stakes) periods of the year. A strong broker removes the guesswork and helps you avoid costly errors.

Here’s what that looks like in action:

- Clear, jargon-free communication for employees

- Educational materials and decision support tools that match your workforce

- Accurate plan setup and eligibility management

- Fewer repetitive questions landing in HR’s inbox

The best brokers also bring tech to the table that can make OE a breeze. For example, platforms like Healthee include a Plan Comparison Tool (PCT) that helps employees evaluate their options based on real-life scenarios, such as how often they see the doctor or whether they’re managing a chronic condition.

This level of guidance reduces confusion, boosts satisfaction, and can even lower overall claims costs.

Sign #2: They act like a consultant, not a middleman

A good broker will quote rates. A great broker will help you think long-term.

The right partner will bring a consultative approach to your benefits. They’ll look not just at what you need now, but where your business and workforce are headed. That includes:

- Forecasting future claims trends and cost increases

- Helping you evaluate whether self-funding or level-funding could work

- Bringing in wellness or mental health programs to improve employee outcomes

- Advising on risk management strategies that protect your business from unexpected claims spikes

In short, they’re not just executing your strategy. They’re helping shape it.

Sign #3: They deliver real financial value

Health benefits aren’t cheap. A recent Gusto report showed that the median health insurance premium for small businesses in America has risen 23% since 2022, outpacing inflation by 13% over the period.²

But with the right broker, you can get more value from every dollar you spend.

This means:

- Strong carrier relationships that lead to better rates or added perks

- Ability to bundle medical, dental, vision, and voluntary benefits for better efficiency

- Data-driven recommendations that help reduce overuse or underuse of services

- Support with cost-containment strategies, from pharmacy benefits to specialty care navigation

When brokers work with Healthee, their clients have access to a wide range of cost-saving opportunities. For example, Healthee helped a global technology manufacturing company identify over $10.6 million in suspicious claims from 2025 through our AI-powered fraud, waste, and abuse (FWA) team.

While your broker might not offer tech like this directly, they should be aware of solutions that make this kind of savings possible and be eager to bring them to the table.

Sign #4: They know what’s next (so you’re not left behind)

Your benefits strategy needs to evolve just as fast as the healthcare market, and your broker should help you stay ahead.

The right partner is bringing fresh ideas to the table before you even ask, such as:

- AI-powered plan-matching tools for smarter enrollment

- Digital-first benefits education and navigation

- Personalized portals that make it easy for employees to access what they need

- Analytics tools that surface trends and cost drivers

- Guidance on integrating point solutions without overwhelming your team

If your broker isn’t talking about personalization, AI, or analytics, you should come to them with specific questions on how you can start incorporating them into your strategy.

A recap: How to choose the right health insurance brokers for small business

At this point, you have a pretty solid idea of what makes a broker stand out.

Here’s an overview of what we recommend looking out for as you evaluate your options:

- Experience with businesses of your size and in your industry: A broker who understands the realities of small business operations, and has experience serving similar companies, will be better equipped to offer relevant, right-sized solutions.

- Access to multiple carriers and plan types: Your broker should bring a range of options to the table, not just one or two plans. This ensures you’re getting competitive pricing and can customize your benefits to meet the needs of your workforce.

- Transparency around fees, commissions, and incentives: A trustworthy broker will clearly explain how they’re compensated and disclose any carrier incentives, so you know they’re prioritizing your needs.

- A tech-forward approach that includes decision support and employee education: Look for brokers who integrate with digital tools that simplify open enrollment, improve plan selection, and help employees make smarter choices throughout the year (without putting extra strain on your HR team).

- A long-term mindset focused on outcomes, not just renewals: The best brokers think beyond the annual plan cycle. They help you forecast, adapt, and continuously improve your benefits strategy based on real data and your company’s evolution.

If a broker can’t clearly explain how they’ll help you evolve and improve your benefits strategy over time, it may be a good idea to revisit whether the partnership still aligns with your goals.

Offer big-company benefits with confidence

Small businesses shouldn’t have to compromise when it comes to benefits. With the right broker by your side, you can build a competitive, cost-effective, and intuitive health plan that keeps your employees happy and your budget intact.

Want to learn more about platforms like Healthee that can help you and your broker simplify open enrollment, reduce costs, and support employees year-round? Let’s talk!