When your clients ask you for advice on how they can reduce costs in 2027, what will you suggest?

With health benefit costs climbing faster than at any point in the last 15 years, it’s crucial to look beyond familiar solutions and focus on scalable ones that deliver results. You might have a point solution in mind that promises to reduce musculoskeletal (MSK) spend by 20%, or a digital tool focused exclusively on fertility.

Those are good tools. But benefit-specific add-ons alone won’t be enough this renewal season. What your clients are really asking for is this: “Can you help us build a smarter strategy and help our people actually follow it?”

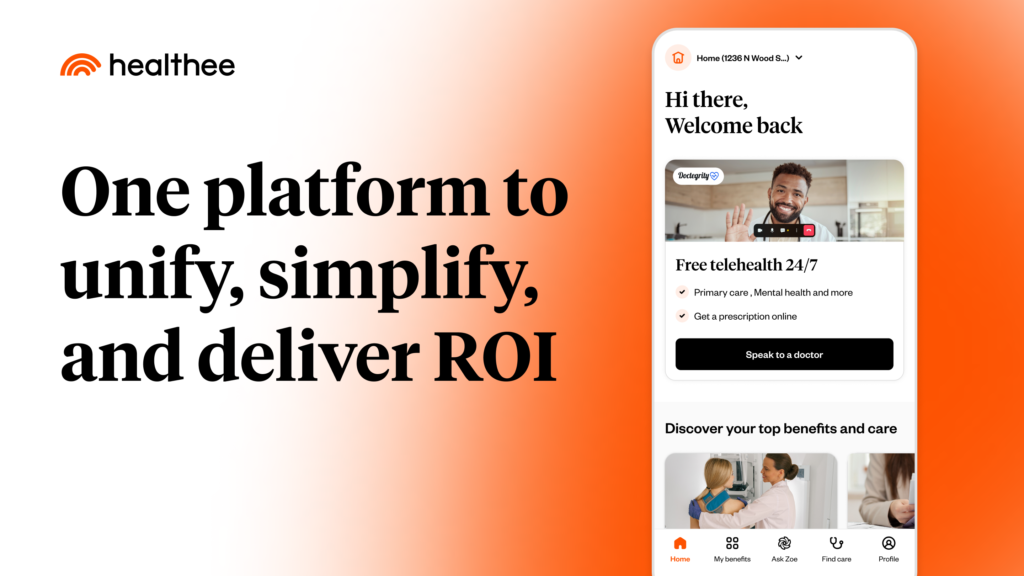

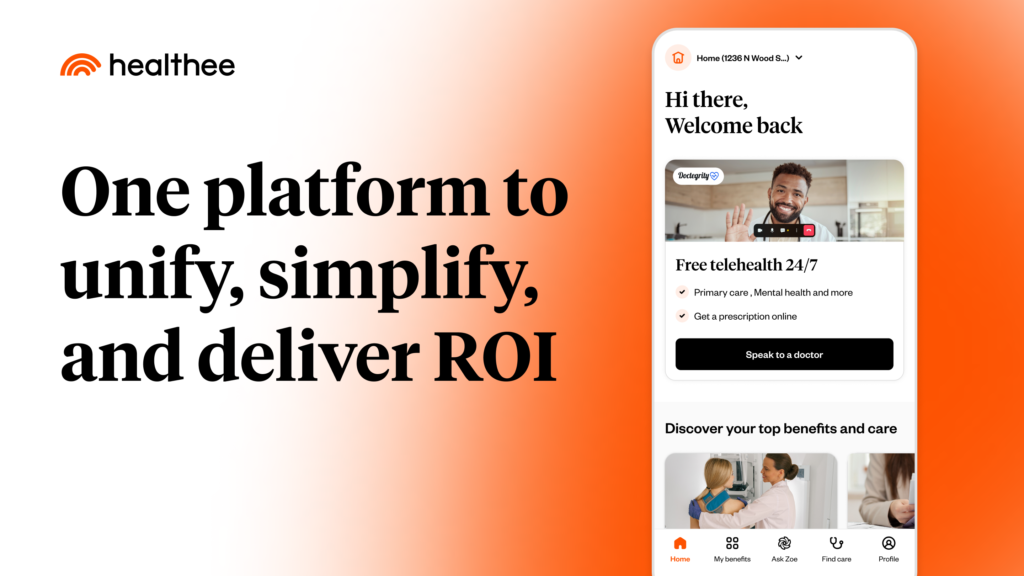

That’s where AI-powered platforms like Healthee come in. They reduce healthcare costs across the board while also taking their employees’ benefits experience into account. They help execute your strategy with speed and measurable impact. As advisors and consultants, this is your moment to lead and position your clients for success.

The status quo won’t get you through 2027

Point solutions have become the go-to fix for very real problems in the past decade: MSK costs, mental health access, Rx price spikes, and so on. But when your client has ten different vendors serving ten different slices of their healthcare spend, what they’re left with is fragmentation, complexity, and minimal ROI.

One study found that the direct cost of employers sorting through the complexities of health and benefits administration was about $21.57 billion.¹

Healthcare isn’t just expensive; it’s confusing for everyone. Most employees still don’t understand how to pick the right plan, where to go for care, or how to make cost-effective decisions throughout the year. That leads to over-insurance, underutilization, delayed care, and unnecessary claims. All of which quietly drains your client’s budget.

Point solutions treat the symptoms, but AI platforms help solve the root causes.

If you’re not already talking to your clients about how AI can simplify plan navigation, improve employee decisions, and reduce claims system-wide, now is a great time to start. I guarantee they’re already seeing headlines about AI’s potential, and they’ll be very interested in applying it to their benefits strategy.

How AI platforms drive system-wide cost control

As a broker or consultant, you’re the coach. You’re building the benefits playbook. You help your clients design smarter plans, reduce waste, and spur engagement across the workforce.

AI platforms like Healthee make sure your playbook is actually executed by guiding each employee to the right choice, at the right moment, for the right cost.

Here’s how that looks in practice:

Plan comparison support that guides smarter enrollment

AI tools guide employees through plan selection by comparing options based on their personal care needs, budget, and preferences. This leads to better plan fit, reduced over-insurance, and greater adoption of lower-cost options like HDHPs when appropriate.

AI benefits assistant that reduces HR support burden

Employees get instant answers to their benefits questions 24/7 through conversational AI without needing to email HR or submit tickets. By offloading routine inquiries, HR teams reclaim hours every week and reduce the risk of miscommunications or enrollment mistakes.

All-in-one benefits hub for better engagement

With plan documents, ID cards, provider search, and care navigation tools all centralized in one app, employees can access everything they need from a single place. That simplicity increases engagement with lower-cost options and decreases reliance on inefficient or high-cost care pathways.

Benefits analytics that reveal savings opportunities

AI-driven platforms surface insights on plan utilization, employee behavior, and vendor performance. These analytics help employers pinpoint where costs are rising, which benefits are being underused, and how to make data-informed adjustments that drive long-term savings.

P.S. Platforms like Healthee can integrate with your client’s existing carrier or ben-admin ecosystem in as little as 6 to 8 weeks without heavy IT lift or disruptions.

The elephant in the room: AI and data privacy

When considering AI solutions, be sure to confirm whether it’s built with privacy in mind.

Today, many digital-native Millennial and Gen Z employees turn to open-access platforms like ChatGPT to get fast answers about benefits. The problem is that those tools don’t have any of your client’s benefits details. They respond with inaccurate information that causes employees to make costly decisions. And since it’s not private, any personal details employees share in the chat can be exposed.

At Healthee, we take data privacy and security seriously. Our platform is fully HIPAA-compliant, SOC 2 Type II certified, and built with encryption at every level, from employee input to system-wide reporting. We don’t sell or share employee data, and clients get full transparency into how AI insights are generated.

When you offer AI to your clients, make sure it’s a platform that keeps employee data protected and supports compliance across HIPAA, ERISA, and other benefits-related regulations.

What happens when employers use AI-powered platforms (real-world example)

Consultants often ask me, “What kind of ROI can my clients expect from a solution like Healthee?”

The figures will vary depending on an employer’s size, their premium spend, plan design, and employee engagement levels, but here’s just one example:

A leading social media company with over 4,000 employees partnered with Healthee to drive smarter benefits choices during open enrollment. In just two weeks, they saved over $476,000. Specifically, $214,000 in lower claims and $262,000 in reduced premium costs. They also reduced HR admin hours by over 1,200 and saw a 20% increase in high-deductible plan enrollment (aligning with their younger workforce’s needs).

These results aren’t edge cases. They’re the result of AI helping employees understand their options and navigate their benefits with confidence.

Be prepared for the questions your clients might ask

You can expect your clients to ask questions like:

- Are we thinking big enough about AI?

- How can we reduce total benefits costs, not just one category of claims?

- How are we helping employees understand their benefits throughout the year, not just during open enrollment?

- How are we going to make sure that we are meeting employees where they are?

- What AI platforms or partners should we be considering to stay competitive and scalable?

Come to your meetings ready to explain how AI platforms work, how they protect data, and most importantly: how they’ll make life easier and less expensive for your clients and their workforce.

Lead with AI in your 2027 benefits meetings

Point solutions still have their place in the benefits ecosystem. But going into 2027, your clients are expecting more comprehensive approaches. They want smarter, scalable solutions that address the systemic problems driving benefits spend.

It’s time to bring AI into your benefits strategy conversations. Your clients are ready for it.