Healthcare costs keep rising, and employers are increasingly focused on finding ways to help employees access care without facing unpredictable bills. One benefit design that’s gaining attention is the no-deductible health plan.

These plans skip the deductible and offer employees coverage without having to pay a set amount out of pocket first. Health insurance plans without a deductible are a great fit for employees who want predictable costs and a clearer view of their healthcare spending.

If your organization wants to balance employee experience with cost control, it’s worth understanding what these health plans are, how they work, and whether they make sense for your team.

What exactly does “no deductible” mean?

Most plans you’re familiar with have some form of deductible, but the amount can vary significantly depending on the carrier. A recent analysis showed that the average deductible for individual, employer-provided coverage was $1,787 ($2,575 at small companies vs. $1,538 at large companies).¹

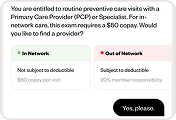

A no‑deductible plan, sometimes described as zero‑deductible or $0 deductible health insurance, means coverage starts immediately. Insured members don’t need to meet a deductible before their benefits take effect.

This differs from traditional high‑deductible health plans (HDHPs) or preferred provider organization (PPO) plans, where employees typically pay first, then see the insurer cover costs after the deductible is met.

Here’s why no‑deductible plans are trending right now

In today’s benefits landscape, cost predictability matters more than ever. Everyone is painfully aware of how expensive healthcare has become — from premiums to prescription drugs to specialty care.

No‑deductible health plans are appealing because employees know what they’ll pay in premiums and copays without worrying about large surprise bills. This can reduce financial stress for many workers, especially those with ongoing health needs or chronic conditions,² and improve their engagement with benefits.

For HR teams and benefits leaders, offering a no‑deductible option can signal that your organization values accessibility and peace of mind. But before you add these plans to your benefits program, it’s important to understand the details of how they function.

How health insurance plans without a deductible work (with plan examples)

Immediate coverage

In no‑deductible plans, the insurer starts paying for covered services from the first claim. There’s no waiting to reach a deductible level before the plan begins to contribute. This reduces the burden of upfront out‑of‑pocket costs and makes routine care more accessible.

For example, under a typical plan with a deductible, an employee might pay the first $1,000 of medical bills before the insurer contributes. With a no‑deductible plan, the insurer begins cost sharing immediately, and the employee’s obligations are largely limited to copays and coinsurance, up to an annual out‑of‑pocket maximum.

It’s worth noting that no-deductible plans usually come with higher monthly payments.

Fixed copays and predictable costs

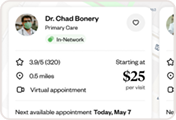

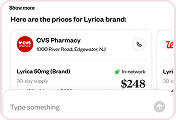

Many health plans with no deductible have copay or coinsurance structures for services like doctor visits or prescription drugs, meaning employees pay a set amount per visit or prescription. This predictability helps employees budget for care. Employers also appreciate that this structure can help reduce unexpected costs for team members who frequently use services.

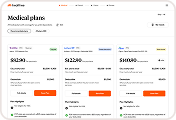

Specific examples of no-deductible plans

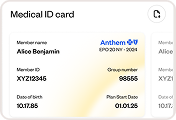

Several major insurers and health plan providers have introduced no-deductible options designed to reduce cost barriers and simplify the care experience. Surest by UnitedHealthcare is a copay-only health plan available through employers that eliminates both deductibles and coinsurance, while still giving members access to UnitedHealthcare’s nationwide network.³

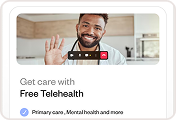

Curative, an emerging provider, offers plans with $0 deductibles and $0 in-network copays or out-of-pocket costs — as long as members complete a baseline health visit early in their plan year.⁴ This model encourages preventive care and early engagement, which are proven methods for driving down health costs over time.

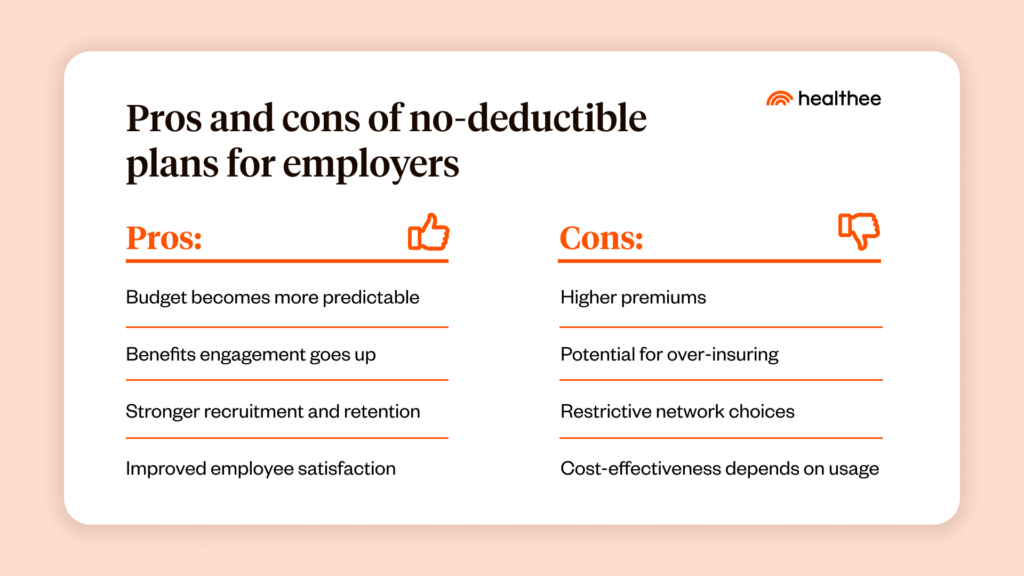

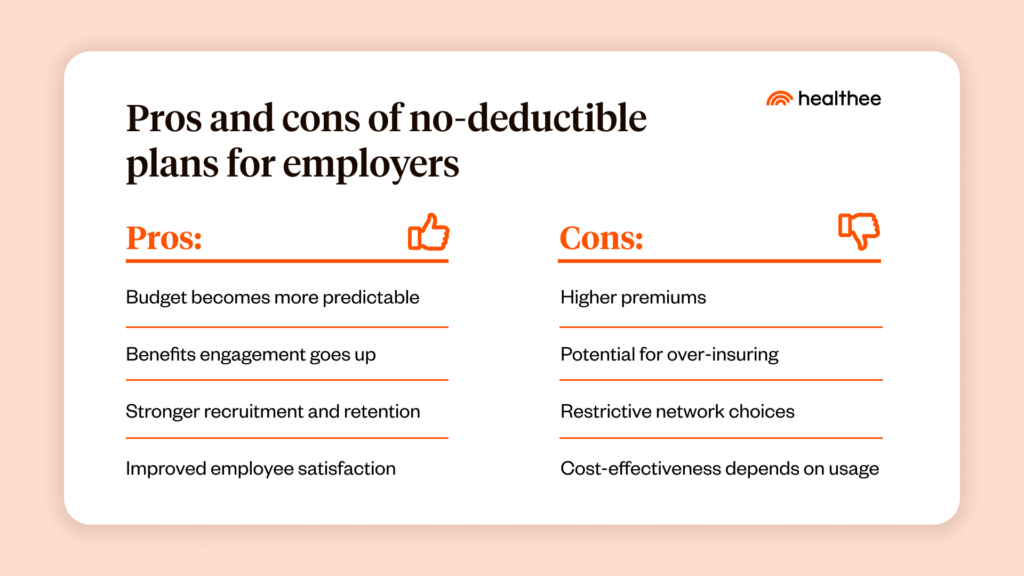

Pros and cons of no-deductible health plans

Like all benefits decisions, no‑deductible plans come with trade‑offs. Here’s what HR leaders should know:

Pros for employers:

- Budget predictability: Helps reduce financial uncertainty for employees, leading to fewer billing questions and less HR involvement.

- Increased benefits engagement: Employees are more likely to explore preventive care when cost barriers are removed, which improves their long-term health outcomes.

- Stronger recruitment and retention: Offering a no-deductible option can set your benefits package apart in a competitive talent market.

- Improved employee satisfaction: Immediate access to care supports a positive employee experience and helps reinforce a culture of care.

Pros for employees:

- Immediate coverage: There’s no waiting to meet a deductible — benefits begin with the first visit.

- Lower upfront costs: Copays and coinsurance replace large lump-sum expenses, making care more financially manageable.

- Easier budgeting: With predictable out-of-pocket costs, employees can better plan for medical spending throughout the year.

- Better access to ongoing care: Employees with chronic conditions or regular medical needs are more likely to stay on top of treatment when they know costs upfront.

Downsides to consider:

- Higher premiums: No-deductible plans typically come with increased monthly premium costs for both employers and employees, since insurers bear more of the initial cost burden.

- Potential for over-insuring: Healthier employees with low expected care use may end up paying more in premiums than they’d spend under a higher-deductible plan.

- Limited plan availability: In some markets, no-deductible options may be more restrictive in terms of provider networks or offer fewer plan design choices.

- Cost-effectiveness depends on utilization: If your workforce doesn’t seek care frequently, a no-deductible model may result in higher total costs without a proportional return in outcomes or satisfaction.

When to offer health insurance plans without a deductible

Deciding whether to offer no-deductible health insurance plans should depend on your workforce demographics, usage patterns, and organizational goals.

1. Workforce fit

If your workforce includes many employees with ongoing care needs, families with dependents, or individuals managing chronic conditions, zero-deductible options can be a game-changer.

Ask your team:

- Do we have a significant portion of employees with chronic conditions or ongoing treatment needs?

- Are family coverage and pediatric care common among our workforce?

- Do employees delay care due to concerns about cost?

2. Utilization data

Review historical health claims to understand how often your employee population uses medical services. High usage suggests a no‑deductible plan could reduce financial barriers and improve employees’ health journey.

Ask your team:

- How often are employees using preventive or specialist care?

- Are out-of-pocket costs keeping employees from fully using their benefits?

- Are we seeing high usage that could justify more accessible coverage?

3. Satisfaction and retention goals

If your employee surveys show frustration with deductible costs or low benefits engagement, offering a no‑deductible plan can be a great move. It sends a strong message that you’re listening and prioritizing access to care.

Ask your team:

- Have employees expressed dissatisfaction with deductible levels or their overall benefits selection?

- Are benefits a reason employees are leaving or hesitating to join?

- Would a more accessible plan help us stand out in a competitive hiring market?

Keep in mind that no single plan design fits all. Some employers arrange a menu of plan options (including high‑deductible, traditional low‑deductible, and no‑deductible plans), allowing employees to choose based on their needs and financial situations.

How do you help employees choose plans confidently?

People often struggle to understand the differences between health plans, which can lead to confusion, under‑utilization, or even regret after enrollment.

Decision support and clear comparisons

To help employees make informed decisions, offer them intuitive tools and resources. Consider incorporating:

- Side-by-side plan comparisons that include total expected annual cost, not just premiums.

- Breakdowns of common care scenarios (e.g., “What if I go to the doctor once a year?” vs. “What if I have ongoing physical therapy?”).

- Real-life examples or personas to show how different employees might evaluate plan options.

- Glossaries that define key terms like coinsurance, out-of-pocket max, and formulary tiers.

- Quick-access digital tools that people can use on demand, not just during open enrollment meetings.

Making Healthee-er choices with ease

Healthee’s decision support tools make it easier for employees to navigate their health benefits. With personalized guidance and benefits literacy support, employees can understand how a no‑deductible plan compares to other policies and pick the right coverage for themselves and their families.

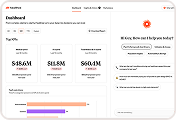

Case Study: Maximizing decision support for employees

A large beverage distributor partnered with Healthee to streamline open enrollment and improve benefits decision support for nearly 5,000 employees. Before Healthee, their HR team faced a high volume of employee questions and struggled to provide the personalized support workers needed to choose the right plans.

After integrating with Healthee, 89% of employees completed their open enrollment selections through the platform. The average time spent choosing a plan was just nine minutes, and HR reported an 81% reduction in administrative workload. Healthee also provided insights into plan eligibility and utilization, helping the company better understand benefits engagement across the workforce.

With simple plan comparisons and 24/7/365 access to guidance, employees made faster, more confident decisions.

Empower your employees with health plans that work for them

No‑deductible health plans can improve access to care and boost employee satisfaction by removing upfront cost barriers and offering predictable coverage. While they typically come with higher premiums and fewer plan options, they can be a smart fit when aligned with your workforce’s needs and backed by the right support.

With clear communication and tools like Healthee, your HR team can help employees make confident choices and get more out of their health benefits.