For any business leader or HR professional asking how much does it cost to offer employees health insurance, the short answer is: it depends. But in 2024, the average annual cost per covered employee is well into five figures … and that’s just the beginning.

Understanding the full cost of employer-sponsored healthcare means looking beyond premiums. Plan design, contribution strategy, company size, and administrative burden all factor in. In this post, we break down the real numbers, offer typical benchmarks, and explain what levers employers can pull to manage spend — without cutting benefits.

How Much Were Employer Healthcare Costs in 2024?

According to the Kaiser Family Foundation (KFF), the average annual cost of employer-sponsored health insurance in the U.S. is now $8,435 for single coverage and $23,968 for family coverage in 2023, with expected increases in 2024 driven by inflation and specialty drug costs. Employers typically cover around 73–83% of that total cost, depending on company size and plan design.¹

That means for every employee enrolled, most employers are spending:

- $6,100–$7,000 per year for single coverage

- $17,000–$20,000 per year for family coverage

Multiply that across a workforce, and it’s easy to see why healthcare is one of the top three line items on most employers’ budgets.

Costs by Company Size: What Small vs. Large Employers Pay

Smaller businesses (fewer than 200 employees) often face higher per-employee healthcare costs due to limited bargaining power, fewer plan options, and lower risk pooling. These challenges are especially acute for employers who are new to offering benefits or who haven’t yet partnered with a broker, TPA, PEO, or group purchasing organization (GPO). Without that professional support, smaller companies may struggle to navigate complex plan designs, negotiate rates effectively, or access the same network discounts that larger employers take for granted.

For mid-sized companies with 50 to 499 employees, those averages drop slightly, to around $6,900 for single coverage and $20,000 for family coverage. At this scale, many employers begin to explore partially self-funded or level-funded arrangements that offer more flexibility and potential savings, though they still rely heavily on strong broker relationships and stop-loss protections to manage volatility.

At large organizations with 500 or more employees, employers typically spend about $6,100 per single plan and $19,400 per family plan each year. These savings are driven by economies of scale, predictable claims patterns, and direct negotiation leverage, enabling some to even self-fund their plans entirely.

These differences have major budget implications for startups and SMBs, weighing when and how to offer healthcare coverage. Partnering with experienced advisors or adopting digital benefits platforms can help smaller employers bridge that gap, improving affordability and competitiveness in their benefits strategy.

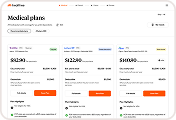

Plan Design Drives Cost: PPOs vs. HDHPs

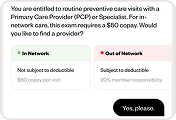

The type of plan offered plays a big role in employer spend. Preferred Provider Organization (PPO) plans are still the most popular, but also among the most expensive. Meanwhile, High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs) offer a lower upfront premium, but shift more responsibility to employees.

Among family health plans, Preferred Provider Organization (PPO) coverage averages a total annual premium of about $24,265, with employers typically covering around 78% of that cost.

By comparison, High Deductible Health Plans (HDHPs) are slightly less expensive overall, averaging $22,534 per year, with employers contributing approximately 80% on average.

Employers often choose HDHPs not just for the savings, but because they encourage cost-conscious healthcare decisions, particularly when paired with education and navigation tools.

Fully-Insured vs. Self-Funded: What’s the Cost Tradeoff?

Most small and mid-sized employers stick with fully-insured plans, which means paying a fixed premium to an insurance carrier each month. But larger companies (often 200+ employees) may consider self-funding, where the employer assumes more risk but can potentially save long-term by paying actual claims costs.

- Fully-insured: Predictable premiums, easier administration, but less control

- Self-funded: Lower average spend, more flexibility, but higher claims risk

Some companies also explore level-funded plans, a hybrid that offers fixed monthly payments with the potential for year-end savings if claims are lower than expected.²

Contribution Strategy: What Employers Actually Pay

Employers use different methods to subsidize health insurance for employees:

- Percentage-based model: e.g., 80% of premium covered by employer

- Fixed-dollar contribution: e.g., $500/month regardless of plan

- Employee-only coverage: Some employers cover only individual plans, requiring employees to pay full price for dependent coverage

The more generous the contribution, the higher the total cost — but also the higher potential for employee retention and satisfaction.

What’s Driving Cost Increases?

Several factors continue to push employer costs higher each year. But the most common and highest-impact cost drivers are:

- Rising claims due to chronic conditions and specialty drugs (think GLP-1s, cancers, etc.)

- Increased utilization of mental health and telehealth services

- Administrative complexity in managing multiple carriers and benefits questions

- Low employee understanding of benefits, leading to higher out-of-network costs and poor plan selection

Employers can’t control market trends, but they can control how they educate employees, structure their benefits, and streamline HR processes.

How Do You Maximize Value Without Cutting Benefits?

Cost containment doesn’t have to mean reducing coverage. Many employers now turn to benefits navigation tools that help employees make smarter choices during enrollment and in real time, lowering claims costs and HR overhead.

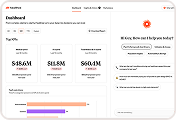

At Healthee, we’ve seen employers save 7–14% on total healthcare spend by offering:

- A personalized plan comparison tool

- 24/7 AI assistant for benefits questions

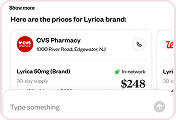

- Pharmacy cost comparisons

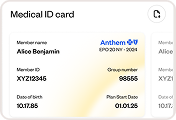

- Digital Medical ID and centralized resource access

The result? Lower claims, faster HR response time, and more value from your benefits spend.

Final Word: Know What You’re Paying For

So, how much does it cost to offer employees health insurance? The average cost is measurable — but the total value depends on how it’s managed. Every employer’s situation is different, shaped by workforce demographics, plan design, contribution strategy, and the tools in place to help employees make smarter healthcare decisions.

Rising healthcare costs aren’t going away, but forward-thinking companies are shifting their focus from cost control to value optimization. That means empowering employees to engage with their benefits, guiding them toward in-network, cost-effective care, and freeing HR teams from the daily grind of benefits administration.

At Healthee, we help employers unlock that value by simplifying benefits navigation, improving transparency, and turning complex healthcare decisions into clear, actionable insights. The result? Lower claims, happier employees, and a healthier bottom line.

References

1. KFF. “2023 Employer Health Benefits Survey.” https://www.kff.org/report-section/ehbs-2023-summary-of-findings

2. Investopedia. “Multiple Employer Welfare Arrangement (MEWA).” https://www.investopedia.com/terms/m/mewa.asp