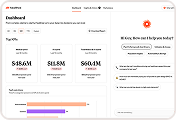

Employers are facing a new reality: health benefit costs are climbing faster than at any point in the last 15 years. A recent New York Times article highlighted survey data showing that companies expect the sharpest increases in medical costs since 2010, and many will be forced to pass more of the burden onto employees.¹ Mercer’s latest study echoed the concern, noting that even after adjusting plan designs, employers still anticipate health costs to rise nearly 9 percent in 2026.²

The alarms are blaring the same collective tune: healthcare costs will continue to rise into 2026. The real risk? Employers who do nothing to adapt.

The Real Cost of Doing Nothing

Health spending has gone up every year since 2020, and this year’s spike is fueled by multiple factors such as inflation, expensive new therapies, and higher demand for care.¹ While purse strings are tightening for employers, workers, unfortunately, are often hit hardest. Nearly one in three Americans now say they cannot afford the care they need.¹ This sobering reality should remind employers of the strong connection between employee health, overall wellness, and job satisfaction. Addressing rising costs with thoughtful employer-led strategies is not only a financial decision; it is also a cultural one that sets the tone for how employees feel supported.

The ripple effects of cost-related economic strain go far beyond unexpected medical costs. Employees who can’t afford high costs of care often delay care, becoming more likely to face serious health issues later. This can lead to more sick days, reduced productivity, and higher turnover. For employers, that means paying more while getting less in return.

1. Smarter Plan Design

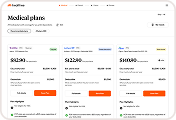

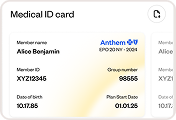

High-deductible health plans (HDHPs) and tiered networks are becoming more common for a reason. They steer employees toward higher-value care while helping employers manage premiums.² The challenge is that employees often struggle to understand which option is right for them. Healthee’s plan comparison tool solves that by using each employee’s unique situation and anticipated health needs to recommend the best-fit plan, which removes guesswork and builds confidence in their choices.

2. Telehealth as First-Line Care

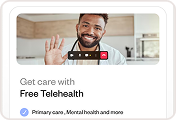

Telehealth has become one of the most effective tools for cost control. By first directing employees to virtual visits instead of costly ER or urgent care centers, employers can cut spending dramatically. One Healthee client in the education sector saved $80,000 within just 10 weeks of using our telehealth services.

3. Transparent Pricing Tools

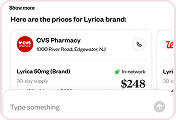

Healthcare price transparency can sometimes start to feel like a throwaway buzzword, but it’s important to remember how critical it is for employees who want to make smart financial decisions. Giving workers access to clear pricing empowers them to compare options and make smarter financial decisions.

With Healthee’s powerful AI tools (we might be biased), we can surface real-time cost differences. For example, Healthee can show that one provider charges nearly $1,000 less than another for the same MRI, so employees can feel confident they are getting the right care at the right price. When employees are able to lower their healthcare costs with strategic planning, employers also pay less in the end through lower-cost claims. Win–win, we’d say.

4. Routine Care Redirection

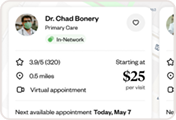

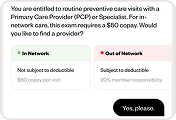

One of the most effective ways to reduce costs without cutting benefits is by guiding employees toward in-network providers. The cost difference between in-network and out-of-network visits can be hundreds of dollars, both for the employee and the employer. Care redirection strategies, whether through plan design, proactive communication, or digital navigation tools, ensure that employees receive high-quality care while keeping costs manageable. Healthee’s AI assistant is one example of how technology can make these choices easier by automatically highlighting the most cost-effective in-network options.

5. Employee Education via AI

Even with good plan design and price transparency, benefits can still feel overwhelming. Employees often turn to HR with basic questions about coverage or costs, which can quickly overwhelm people teams during open enrollment and throughout the year.

Education and HR task automation is the missing link: when employees understand their benefits, they use them more effectively and avoid costly missteps. This is where AI-powered support tools, such as Healthee’s virtual assistant Zoe, can help by answering questions instantly and around the clock. The result is less time spent chasing answers, more confidence in care decisions, and a lighter administrative load for HR.

Why Empathy Belongs in Every Cost Strategy

Employers sometimes forget that cost containment is not just about balance sheets. Every increase in premiums, deductibles, or copays lands directly on families. With groceries, rent, and childcare already rising, healthcare costs can, and often are, a tipping point for financial stress.¹

Healthee was built with empathy at the core. We understand the pains of healthcare navigation and have experienced them ourselves. Our design focuses on real-world accessibility, clear language, and around-the-clock support. The goal is not only to save money, but also to give employees back a sense of control over their health decisions.

A Better Way Forward

In reality, employers cannot stop the rising tide of healthcare costs, but they can decide how to respond to the shifting economic landscape. The choice is between cutting benefits or helping employees become smarter healthcare consumers. One path leads to frustration and disengagement. The other creates a healthier, happier productive workforce.

The answer is pretty clear to us at Healthee.

Feel like you’re going down the wrong road? Let’s talk.