Every industry has a set of components that serve as the foundation of successful benefits packages. At the top of this list is health insurance.

Health benefits make up a big chunk of organizations’ costs, with rising premiums showing no signs of slowing down. Not to mention the constant challenge of ensuring the health plans are effective and financially viable.

As a result, the role of finance executives has become more important than ever. They must ensure healthcare solutions align with the company’s overall goals while providing employees comprehensive healthcare coverage. But how can you analyze the effectiveness of your health plan strategy?

In this article, we will discuss the key metrics you can use to assess the success of your health plan offerings. These critical metrics can help determine necessary adjustments for more effective offerings, enhancing employee satisfaction, and, last but not least, saving money.

What are health plan performance metrics?

Health performance metrics are well-defined measures used to observe, analyze, optimize, and transform a healthcare plan. They are designed to identify opportunities for cost reduction while enhancing the quality and delivery of care to employees.

10 essential metrics and KPIs to analyze health plan performance

Here are ten key metrics to assess health plan performance:

Key Metrics To Track Cost of Care

Cost Per Member

This metric lets you identify cost patterns to plan your healthcare budget better. Tracking this metric helps you evaluate where to reduce costs while ensuring the quality of coverage and benefits are not compromised. Typically, you can calculate this by simply dividing the total healthcare expenses, say for a month, by the total number of members covered during that month.

Utilization Rates

Utilization rates reveal how often your plan members are using their health plans. With this crucial metric, you can identify whether utilization rates are high or low. High utilization rates can be concerning as they may signal employee health issues, while low utilization rates could indicate employees aren’t using their health benefits as much as they need.

Here’s a simple formula to calculate your utilization rate:

Utilization rate = (Actual usage / Potential or maximum usage) x 100%

The actual usage means the number of employees who have used or requested the service in a given period.

On average, 66% of private industry employees utilize the healthcare plans provided by their employers, according to Bureau of Labor Statistics 2022 data.

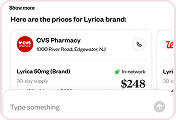

Prescription Drug Use and Expenditures

A huge chunk of plan costs go to prescription drug expenditures. Help manage pharmaceutical spending by tracking drug consumption patterns and prices. With this data, companies can decide whether to negotiate lower drug pricing, promote generic alternatives, or make changes for cost-effective pharmaceutical coverage. However, it’s important to consider the potential impact limiting pharmaceutical options can have on employee satisfaction.

Key Metrics To Assess Health Plan Coverage

Medical Loss Ratio (MLR)

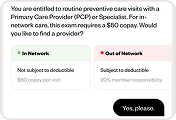

This metric calculates the percentage of premiums spent on medical claims and healthcare services. The Affordable Care Act requires health insurers to spend 80% – 85% of premium dollars on clinical care and quality improvements.

Let’s say an insurance provider uses 80 cents out of every premium dollar to pay members’ claims; this means the company has a medical loss ratio of 80%. Theoretically, the smaller the MLR is, the more cost-effective your healthcare services are. In contrast, a higher MLR can mean the insurance company is either overspending on medical services or is simply not generating enough revenue per member. Alternatively, it could mean that the insurance company is making strategic efforts to provide higher-quality or more effective services.

Health insurers must submit annual reports detailing their Medical Loss Ratio (MLR) as part of the Affordable Care Act’s regulatory framework. They must also issue rebates to covered individuals if the percentage doesn’t meet minimum standards.

Understanding how your current plan compares to industry standards can help you negotiate premium terms or coverage details if necessary. You can check your insurers’ MLR reports on the Centers for Medicare & Medicaid Services (CMS) website.

Network sufficiency

Factors that measure how well a healthcare provider can meet its members’ needs

-

Network Providers

-

Healthcare Accessibility

-

Specialties Range

-

Appointment Wait Time

-

Healthcare Cover

Network sufficiency is a key indicator of how well your network of healthcare providers can meet the needs of insured members. Network sufficiency represents an evaluation of factors such as

- The number of providers within the network,

- Accessibility of healthcare services,

- The range of medical specialties covered,

- Appointment wait times,

- And the financial impact on covered individuals when seeking services outside the network.

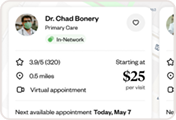

In simple terms, the network sufficiency metric analyzes how effectively plan members can get critical healthcare services without paying exorbitant out-of-network fees. Companies can use this data to talk with providers about expanding coverage to help employees maximize their benefits.

Results of Health Risk Assessments (HRAs)

A health risk assessment is a tool used to collect health information to evaluate a person’s overall state of health. Data from HRAs, including medical history and lifestyle, can help companies prepare financially for employees’ health conditions. It also shows the importance of strategizing wellness programs focused on preventive methods.

Please note that checking and being aware of any relevant legal considerations — such as privacy and confidentiality — is essential before conducting a health risk assessment.

Chronic Disease Management

Unlike other health conditions, chronic diseases are more long-term and require more attention. So, it can be worthwhile to monitor chronic disease management to determine if your health plan’s preventive and intervention treatments are effective and if your health program is providing necessary care to employees with chronic health conditions.

This metric evaluates health plan effectiveness by looking at how a plan prevents, manages, and improves outcomes for individuals with chronic conditions. It scrutinizes the success of preventive screenings, vaccinations, early interventions, and initiatives to provide resources for self-management, lifestyle modifications, and personalized care plans for individuals with chronic conditions.

Key Metrics To Evaluate Employee Feedback on Your Health Plans

Employee Satisfaction and Engagement

What better way to know if your health-care plans are effective than to ask your employees themselves? Employee satisfaction frequently leads to higher productivity and lower attrition.

Employee Absenteeism and Productivity

According to the Bureau of Labor Statistics’ 2022 data, around 7.8 million employees did not show up for work because of illness or medical problems in January 2022.

So, if your employees are taking more sick days, it may be time to adjust your health plan offerings. Remember that a high-performing health plan contributes to a healthier, more engaged workforce, encouraging productivity. When evaluating your health plan, considering absenteeism and productivity metrics allows you to align health and well-being with business goals.

Participation in Wellness Programs

Tracking participation rates, completion of wellness activities, and engagement with health initiatives provide insights into the effectiveness of your wellness programs. Monitoring this metric allows you to assess whether there’s a need to strategize on new programs or modify them according to demographics and other workforce considerations.

Industry Trends and Benchmarks and addressing this with Healthee

Healthcare is a rapidly changing industry, with evolving medical trends and increasing technological advancements.

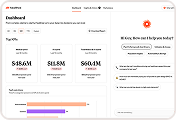

A health benefits platform like Healthee can help you better understand the trends among your employees:

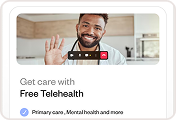

Telehealth services

Telehealth has changed the course of healthcare, giving people more access to cost-efficient health plans. While it’s not new, more and more companies are now recognizing the benefits of including telemedicine in their health programs and the convenience that comes with it.

Healthee can help you in this shift, allowing your employees to obtain medical consultations in the comfort of their own homes. This encourages convenience and timely care while lowering expenses associated with in-person visits.

Value-based care

Value-based care means healthcare providers earn for the actual results of services they deliver to their patients. This can include the quality, equity, and cost of care. Many businesses have been veering away from fee-for-service models and switching to value-based care to improve care coordination and cost control.

Analytics-driven insights from a health benefits navigation platform, such as Healthee, can help create a value-based strategy to optimize patient outcomes.

Mental health support

According to a survey by Workable, 92.6% of employees have experienced mental health challenges that have impacted their work. So, mental health treatment utilization metrics are a healthcare consideration that is nothing to sneeze at for helping create better and more effective health plans.

The Healthee platform makes finding in-network mental health services easier while also protecting user privacy.

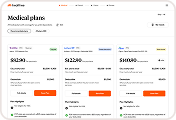

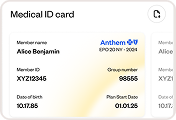

Personalization and Choice

Each employee has different health conditions, needs, and preferences, so personalizing their benefits navigation options is key to increasing utilization. Healthee’s price transparency feature empowers users to make informed decisions, helping them choose the most suitable plans and providers while enhancing cost control for employers.

Compliance and Regulation

As healthcare continues to evolve, standards and policies become increasingly important to ensure legal and financial stability. Healthee is committed to the highest data protection standards by being compliant with HIPAA (Health Insurance Portability and Accountability Act). With Healthee, your personal health information is handled with the utmost care and in accordance with strict standards set by HIPAA and the California Consumer Privacy Act (CCPA).

Conclusion

Health plan performance metrics aren’t just numbers; they offer valuable insights into your plan’s efficiency to help you create a health plan that meets the needs of your workforce.

Understanding these metrics lets you create a strategy that not only fits industry trends but also aligns with overall business objectives.

But in such a rapidly changing industry, staying competitive is challenging without the proper health benefits tools. Healthee’s AI-driven platform best fits the role, providing healthcare price transparency, flexible treatment options, and comprehensive benefit insights — helping companies contain costs through clear, actionable data.

With Healthee, you can keep an eye on your ROI while ensuring you give your employees the best care. Book a demo and learn how you can get more bang for each healthcare buck with Healthee.