For small and mid-sized businesses (SMBs), navigating health insurance can feel like solving a puzzle that keeps shifting. Premiums continue to rise annually, compliance rules are difficult to follow, and the administrative work never seems to end.

By partnering with a Professional Employer Organization (PEO), businesses can tap into large-group benefits, reduce administrative complexity, and gain access to better coverage — all while staying focused on growing their team. PEOs offer a cost-effective, simplified solution for delivering strong health benefits.

In this blog, we’ll break down what you should know about PEO health insurance, including the top advantages for SMBs and how to find the best PEO partner for your business.

What is PEO health insurance? (and why it matters)

A Professional Employer Organization is a service provider that partners with your business to handle key HR functions — such as payroll, benefits, compliance, and employee onboarding — through a model called co-employment.

What does that mean for you as an employer?

You’ll keep control of your day-to-day operations, hiring decisions, and company culture. Meanwhile, the PEO becomes the employer of record for tax and benefits purposes, which allows your team to be part of a larger employee group. This gives your business access to big-company benefits, better rates, and HR support.

Finding high-quality coverage at a reasonable cost can be tough for smaller teams. A limited group size often means you get higher premiums and fewer options. About 94% of small employers find it challenging to manage the cost of offering employer-sponsored health insurance, with almost half reporting it as “very challenging.”¹

By using PEO health insurance through the co-employment model, small businesses can access more robust health plans typically reserved for larger companies.

Types of businesses that should consider a PEO

Working with a PEO can be a good idea for many small to mid-sized businesses, especially those that want to provide competitive benefits without having to build a full HR team.

Here are the types of companies that typically benefit most:

- Growing companies with 5 to 200 employees

- Teams with multi-state or remote employees

- Professional services firms (e.g., consulting, tech, law, marketing)

- Companies hiring for competitive roles

- Businesses looking to offload benefits admin tasks

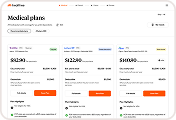

PEO costs and pricing models

According to TriNet, a leading PEO and HR administrative service provider (ASO), here are three standard pricing models you should know²:

- Percentage-based pricing: Generally 2-12% of employee wages, with rates typically decreasing as payroll volume increases.

- Flat fee models: A fee is charged per employee.

- Hybrid structures: Some providers combine base administrative fees with payroll percentages or usage-based charges. For example, they might charge a flat insurance fee plus a percentage of payroll for administration and tax-related services.

The operational costs of working with a PEO can vary, but they typically involve ongoing admin fees. Some PEOs may also charge technology or platform fees for access to their HRIS systems, reporting tools, or employee self-service portals.

Depending on the services you pick, you might pay more for specialized consulting or add-on support tailored to your business.

Transparency is essential when you’re discussing costs. A clear PEO contract should outline all fees upfront, so you can accurately forecast expenses and understand the full value of the partnership before signing on.

5 key benefits of PEO health insurance

PEO health insurance can unlock several advantages for small businesses,³ such as:

1) Accessing more competitive health plan pricing

Reputable PEOs have buying power and relationships with multiple insurance carriers. They can negotiate with them directly to secure plans with better pricing and comprehensive benefits. Because your employees are pooled with a larger group across the PEO’s client base, your company benefits from the same pricing that larger organizations receive.

Healthcare costs are climbing faster than at any point in the last 15 years, so it’s crucial that employers act accordingly and consider multiple ways to lower benefits spend.

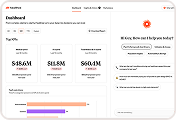

2) Streamlining HR and administrative workload

PEO benefits administration helps decrease internal paperwork and gather information on a central platform. By outsourcing HR tasks, your team can save time (and money) and focus on high-impact initiatives.

Instead of managing enrollment forms, payroll deductions, and vendor coordination, your team can concentrate on talent development, employee engagement, and strategic planning.

3) Enhancing the employee benefits experience

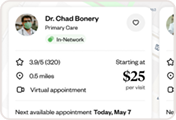

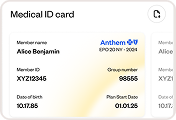

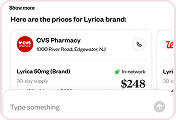

Employees can navigate their PEO health plans more efficiently with resources like mobile apps, dedicated chatbot support, and enrollment tools.

For example, Healthee partners with PEOs to give employees an easy way to compare plans during open enrollment and understand their benefits year-round. With our AI-powered platform, employees can find in-network care, learn about their deductibles, and avoid costly mistakes.

4) Expanding your total rewards offering

Most PEO providers offer a range of insurance and benefits plans, including cyber liability coverage, retirement packages, mental wellness perks, and reimbursement accounts.

This lets smaller companies compete with larger employers on total rewards without the burden of sourcing and managing each benefit independently.

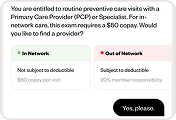

5) Strengthening compliance and risk management

PEOs track state and federal healthcare regulations, so even if you hire staff in a non-resident state, your PEO can provide guidance on local laws.

They also support COBRA, HIPAA compliance, and benefit eligibility rules — helping you avoid costly fines and stay compliant as your team grows across states or industries.

PEO health insurance vs. alternatives

PEOs deliver a convenient bundled experience, but they’re not the only path forward. Depending on your team’s size, structure, and goals, one of these alternatives may also be a good fit:

Traditional group health insurance

You work directly with carriers or a broker to choose and manage plans for your team. This gives you more control over plan design and carrier selection, but it also means taking on administrative responsibilities like payroll deductions, compliance, and renewals in-house.

HRA (Health Reimbursement Arrangement)

Employers reimburse employees for qualified medical expenses. HRAs are often paired with a high-deductible health plan (HDHP). They’re customizable and can be a smart cost-management tool, but they require thoughtful plan setup and communication to ensure employees understand how to use them effectively.

ICHRA (Individual Coverage Health Reimbursement Arrangement)

With an ICHRA, employees choose and purchase their own individual health plans, and the employer reimburses them up to a set amount. This model offers flexibility and cost predictability, especially for remote teams or multi-state workforces. But navigating the individual insurance market can be confusing for employees, and the admin workload for employers can be complex.

How should your business choose a PEO partner?

Here are areas to keep in mind as you research different organizations:

- Accreditation and licensing: Look for certified PEOs (CPEOs) through the IRS or other trusted organizations. This demonstrates their reliability because they’ve met strict financial, legal, and reporting requirements.

- Carrier network and plan options: Evaluate the quality and variety of their health plans. Are the carriers well-known? Do they offer PPOs, HMOs, and HSA-compatible options that your employees will value?

- Technology: A good PEO should provide user-friendly tools for both employers and employees, including benefits portals, payroll platforms, and mobile apps that make it easier to manage HR tasks and boost engagement.

- Transparency: Look for straightforward pricing with no hidden fees. Ask for a clear breakdown of what’s included in their base services versus add-ons, so you can budget with confidence.

- Customer support: Will you have a dedicated point of contact who understands your business? Responsive support makes a big difference when issues come up with payroll, benefits, or employee onboarding.

- Flexibility: Choose a partner that can grow with you. Whether you’re expanding into new states or adding headcount quickly, your PEO should be able to adjust and scale its services to match your pace.

Think of selecting a PEO the same way you would any core partner. Look for an organization that aligns with your team’s values and has long-term potential.